My List of Top ICT Concepts for Successful Trading

110.59k views4373 WordsCopy TextShare

Smart Risk

What is the best ICT (Smart Money Concepts) trading strategy? This video is an advanced tutorial on ...

Video Transcript:

hey guys this video is an advanced tutorial on some of the most effective ICT Concepts that we found incredibly useful for successful trading today we'll explain the definition fundamentals and correct application of each topic on the chart to help you enter highquality trades if that's something that you are interested in as always hit the like button to show your support and subscribe to our Channel if you're new see you after the intro and disclaimer [Music] let's start with the first concept imbalance inefficiency or fair value gaps the SMC trading plan is purely based on price

action and tracking institutional activities or so-called smart money on the chart smart money refers to extremely large orders placed in the market by Banks hedge funds Brokers and other institutions with substantial Capital but how do we identify smart money on the price chart we can identify smart money by identifying imbalances imbalance inefficiency and fair value gaps are highly similar Concepts when smart money enters the market it creates an imbalance between buyers and sellers causing significant price movements with large candles that have gaps between the Wicks if this is the case the price is considered sell-side

inefficient and we have fair value gaps between the Wicks the fair value Gap is a three Candlestick pattern where the Wicks do not meet here you can see examples of efficient and inefficient prices in the first example we have a clear bullish fair value gap between the Shadows indicating cell side inefficiency on the contrary if you look at the second one you'll notice the Wicks meet in the middle therefore we do not have value gaps and the price is efficient now how can we use this to our advantage when the price moves significantly and leaves

fair value gaps behind it usually returns to these areas to fill the Gap and restore balance these areas become extremely important supply and demand zones offering potential trading opportunities in this example the price is moving in an uptrend in this area the price has created fair value gaps indicating buy side imbalance and sell-side inefficiency below the imbalance we can find the demand Zone as this demand Zone has contributed to the imbalance let's imagine the price creates another pullback and we have another demand Zone the key difference is that the second demand Zone has no imbalance

therefore there is a greater chance for the price to make a deep retracement to the demand Zone that created the initial imbalance this is because the inefficiency will act as a magnet for the price to come and fill the this Gap so witnessing this scenario on the chart we will aim for the demand or Supply Zone that created the imbalance this Zone has a greater chance to reverse the price compared to zones associated with efficient movements with all being said the imbalance is a strong SMC signal and one of the first things we spot on

the chart however just like similar Concepts it needs to be used in combination with other factors to make a well-informed trading decision the second concept is liquidity liquidity is essentially determined by the placement of stop losses where stop losses are positioned liquidity is found smart money relies on triggering stop losses to strategically enter the market allowing them to establish their positions effectively every swing high and swing low contains liquidity we know that if the price pulls back to this area many price action Traders will go long and put their stop losses below this level to

benefit from the bull market as the price approaches the swing High Traders will take their profits or even go short at the resistance area thus we have liquidity below the swing lows and above the swing highs in an ideal uptrend the correction will happen inside this range and the price will continue pushing upwards once it has gathered enough bullish momentum and liquidity many price action Traders are observing the chart and looking for a signal to go long this is why forming a bullish engulfing Candlestick can also be a strong liquidity area many Traders will take

it as a sign of bullish momentum and open long positions with their stops below the engulfing candle however as smart Money traders we want to enter the market after the stop losses have been swept that's why if we find a demand Zone below this Candlestick we would wait for the price to enter our Zone and then open a buy position there are many forms of liquidity in the market but we mainly pay attention to equal highs and lows as the name suggests equal lows are formed when the low points are at about the same level

and similarly the price will form equal highs where the highs are about the same level what does this signify in terms of price action the double or triple bottoms created on the chart are great places to look for trading opportunities for many retail Traders they expect a ection to the upside once the price Taps into this area again so they enter long positions at these levels and place their stop losses somewhere below this area the same scenario happens in a bearish market as well when the price Taps into the resistance area retail Traders go short

as they expect a rejection towards the downside their stop losses will be somewhere Above This zone so a lot of liquidity is gathered above this area if smart money wants to sell this pair the conditions are ready ready to push the price Above This resistance area to grab the liquidity and then push the price towards the original bearish Direction the third concept is the market maker model now what is the market maker model in institutional price swings there are two types of liquidity in the market buy side and sells side liquidity above a high or

a group of highs represents buy side liquidity when the price approaches this level bearish Trad ERS will go short or they will protect their previously opened short positions on the other hand breakout Traders will go long if the price breaks through this level the animated movement aimed at grabbing this liquidity is called the buy side delivery it runs high to engage the liquidity above these relative equal highs the algorithmic price delivery engages the liquidity by trapping Traders on both sides and then the smart money goes short now let's apply the same concept to the bearish

scenario liquidity below a low or a group of lows represents sell-side liquidity like in the bullish scenario when the price approaches this level bullish Traders will go long or they will protect their previously open long positions on the other hand breakout Traders will go short if the price breaks through this level the animated movement aimed at grabbing this liquidity is called the cell-side delivery the algorith rithmic price delivery engages the liquidity by trapping Traders on both sides and then the smart money goes long to engage the buy side liquidity when the price creates supports and

internal structures before reaching a demand level it increases the chance of bouncing off that level this is because all these supports attract traders to buy the asset their stop losses are considered sell orders and if smart money wants to buy this asset it needs sellers in the market this Dynamic creates a scenario where the price tends to bounce off the demand level as buyers step in to take advantage of the perceived value and sellers orders are absorbed by the buying pressure with all that being said forming liquidity grab patterns inside the supply and demand zones

are great confirmations for short-term Market structure shifts after the formation of liquidity grab patterns the market will move towards the liquidity zones on the other side Market Direction who is in control identifying the market direction is generally the first step in analyzing a price chart we want to identify the trend and determine if the buyers or sellers are in control we always aim to trade aligned with the controlling side of the market how does the system work the system operates on mitigations when the price mitigates a demand level demand takes control over Supply conversely when

the price mitigates a supply Zone Supply takes control over demand imagine the pric is moving in an uptrend creating a series of higher highs and higher lows each time the price breaks the structure to the upside with inefficiency a demand zone is formed these demand zones remain unmitigated until the price Taps into them offering a perfect opportunity to follow the dominant Trend however if the price breaks below a valid demand area this is called a change of character indicating two things First Supply has taken control over demand second a valid Supply area has been established

the price then continues to move downward forming Supply areas until it reaches the next unmitigated demand area at this point there is a battle between supply and demand sometimes we see a period of consolidation and a ranging Market between these two zones breaking either Zone indicates who takes control here we we have one two and three moves that break above the previous Market structure indicating that demand is in control we have an unmitigated demand area which will act as support when the price returns to this level once more we have a temporary correction and the

price breaks the high with imbalance creating a strong demand area again still the market sentiment is bullish as long as the price trades above the extreme demand now we can see that the market has tested the demand level and failed to create a new higher high due to a lack of buyer strength after breaking below the low point we can conclude that the buyers are no longer in control and we might witness a reversal if we consider this point as the start of the impulsive move that caused the market structure shift here would be our

supply area continuously the market breaks the structures to the downside showing that Supply is in control creating multiple Supply areas each of these Supply areas could be a potential selling opportunity until we reach this unmitigated demand area in front of the price this Zone can be a potential interest area for the buyers to step into the market so at this point we have a battle between the buyers and sellers therefore we must wait and observe the further price action to determine the market Direction because this level can be a turning point for the price or

we might at least witness a temporary correction now here is an important point we cannot control the market however we can prepare ourselves for the different scenarios that might happen now let's continue with the next topic order blocks generally order blocks are optimized supply and demand areas where buying or selling orders reside the market has rejected these levels once so when it returns to these levels it might react to them again every order block is a supply or demand level but not every supply and demand area qualifies as a an order block let me show

you how every reaction to a price level creates a supply or demand area it shows that for whatever reason Traders have opened massive buy or sell positions which cause significant price movements so when the price returns to these levels we closely monitor the price action to find Possible Trading opportunities however trading every supply and demand area would not be effective over time and by observing repetitive patterns on the chart we have noticed that when supply and demand areas are accompanied by certain conditions the chance of success significantly improves one of the key supply and demand

areas is order blocks so first let's see what conditions are required to consider an area a valid order block to trade then I will show you how to effectively mark them on the chart rules of a valid order block the first and second rules are having inefficiency and collecting liquidity which we discussed previously in the video the Third rule for having a valid order block is breaking the market structure in a bullish scenario when a price movement breaks the latest Market structure and closes above the recent High the origin of the price movement becomes highly

important it shows that the demand area that created this movement is not an ordinary level but an influential area in the market structure with all that being said a supply or demand zone is considered a valid order block if it leads to a structural break the same concept applies to the bearish scenario when a price movement breaks the latest Market structure to the downside the origin of the price movement becomes highly important it shows that the supply area that created this movement is not an ordinary level but an influential Zone in the market structure so

these Supply areas are considered valid order blocks here we have a moving uptrend this is the most recent break of structure which shows that demand is still in control all these demand areas are considered an opportunity to go long but here is an important point the origin of this bullish price movement is highly important and provides the best trading opportunities there is a high chance that the rest become a victim of a liquidity grab that's why we have to use a lower risk when placing trades in these areas but always remember if a profitable trading

strategy helps to grow your account the risk management plan help you to survive in the market you can risk 2 to 3% of your Capital per trade and only have up to three open trades at the same time but before using this strategy with real money you should back tested on past data to obtain the performance back testing allows you to build the required confidence and prepare for potential risks associated with the trading but unfortunately it can be very time consuming that's why we use Trader Edge to back test our exclusive trade strategies using Trader

Edge saves us significant time and energy compared to manually recording results in spreadsheets after completing a back test the platform provides a detailed analysis of the results Additionally you can save your progress to continue back testing later if you're interested in using this platform check out the link in the description breaker blocks a breaker block is a failed order block that turns into another Supply or demand area on the chart from basic price action we know that whenever the price breaks through a resist istance level it becomes support due to the behavior of Market participants

similarly whenever the price breaks through a support level it becomes resistance when the market Taps into that area again the same concept applies to order blocks as well the market could ignore an order block supply and demand due to many reasons including a shift in Market structure being overvalued or oversold tapping into a higher time frame key level and more when a valid demand order block fails to reject the price and the price breaks through it becomes a supply level we call it a breaker block expecting that the market will reject this area so right

here this is what a bearish scenario might look like we have a break of structure Above This higher high with inefficiency this move creates a valid order block Zone that can provide us with an opportunity to go long however the market makes a change of character caused by this aggressive move breaking below the previous low as a result the direction bias has changed to bearish and our demand level will turn into Supply after this break occurs the psychology behind breaker blocks is that the traders who went long in the order block are now trapped after

the bearish market structure shift so they would want to wait for the price to get back to their Break Even spot where they can close their Longs for no loss additionally Traders will go short here since they see this area as a key area of Supply the outcome of this double action is what makes the price reverse from this area the last concept on the list is the market structure now what is the market structure exactly Market structure refers to swing highs and swing lows supply and demand areas order flow and overall Market condition we

have two Market behaviors trending and ranging Market in an uptrend as the name suggests the market moves towards the upside creating new high higher highs and higher lows here you see an ideal ascending structure the ideal means that the market respects the lows and continues pushing upwards the important point is that in the uptrend the market has a greater tendency to break the highs to the upside although the market might not always move this clearly this is the general definition that is commonly seen in the market even if you look at the one minute chart

you can see that the upward movement is created by making higher highs and lows so as long as long as the price continues to break the structure levels to the upside we are still in an uptrend now that we've talked about breaks let's see what breaking really means and what conditions we consider in a break of structure but before everything this is the general anatomy of a Candlestick formation on the chart they might come in different sizes and shapes however they become an important subject when we are talking about breaks and liquidity Concepts structure and

liquidity are two Inseparable parts of the market many liquidity areas Find meaning through structure and many structure levels become invalid with liquidity Concepts it can be hard to understand but we'll cover it all today now how does a breakout occur a breakout occurs when a Candlestick clearly breaks the previous Market structure with the body this means that if the price can close a visible amount like a couple of Pips above the previous level we would have a so-called break of structure But Here Comes an important Point how can we ensure this break is valid and

not just a liquidity grab in case of a fake out or liquidity sweep the price immediately gets back into the range so let's make our concept more advanced if the price Wicks above the previous Market structure and closes back inside the range we won't have a valid breakout which we previously discussed but in order to have a valid break the following candle needs to close above the previous one this is a strong sign that the sellers have failed to push the price back back inside the range and the buyers are in control similarly a double

confirmation for a break of structure with a closed body would be to wait for the following candle to violate the highest point of the previous candle this indicates a strong continuation momentum to the upside rather than a liquidity grab remember everything we discussed here is applied to the bearish scenario as well now let's move on to the next topic reversals we previously mentioned that we have two kinds of Market Behavior a trending and a ranging Market sometimes it's hard to identify the direction of the market or it feels like the price has been trapped in

a box the subject of the ranging Market is out of the scope of this video so let's focus on when an uptrend turns into a downtrend and vice versa or in essence when should our overall bias be bullish or bearish as we mentioned earlier the break of An Origin creates a change of character a breakout occurs when a Candlestick closes a visible amount through a level of Market structure so first we must locate the sources to identify the reversal points but here is an important Point scales matter in identifying the change of character for instance

here both of these levels are considered a source because they have broken above the previous Market structure however we won't consider this break a valid change of character the reason is that the failure of of such a small movement is not supposed to be considered a reversal of the trend so here is another rule for a change of character a valid change of character occurs by breaking below the lowest point of the latest impulsive move that is at least half the size of the previous one for example look at this chart if we apply the

concepts of Market structure we would have three impulsive moves like this all of them have created a new high so breaking below the source of each one is considered a change of character but look at the size of the third impulse it's barely even half of the previous move so in this case if the price breaks below the swing low we won't consider that as a valid change of character so basically we compare the scale of the latest impulsive movement with the previous one and it should be at least half the size to consider it

a valid reversal so if the previous move is 40 Pips the latest impulse must be at least 20 or else we have no value valid change of character here in the bearish scenario these are our impulsive bearish movements breaking Above This is considered a valid change of character because this impulsive movement is obviously larger than half the previous one keep in mind that we always compare the latest impulse with the previous one on the chart no matter what your entry strategy is trading along with the dominant Market direction will instantly improve your win rates and

risk to reward ratio now one of the most critical Concepts in identifying the trends and reversal points on the chart is liquidity talking about liquidity generally there is liquidity above the top and below the bottom if we consider this as the market structure the price has more tendency to grab the liquidity below the recent low and then continue pushing higher to grab the liquidity above the recent high but most of the time liquidity is used for Trend continuation this means that in a bullish Market we usually witness the tries sweeping the liquidity below the lows

to gather the fuel for Upward movements Candlestick formations are important in identifying liquidity sweep movement in the bullish scenario a long Wick at the bottom of the Candlestick represents a liquidity grab movement imagine if this area is our previous support so we have lots of buy orders gathered here which means that the stops are somewhere below this level so a long Wick breaking through this area is considered a liquidity grab but only if it won't have a long Wick at the top as well this would be a great sign that the price can start its

movement to the upside it is not possible to define a mechanical structure for all cases but what we want to see is a wick penetrated through the level and quickly returned however this Wick should be at least half the size of the body now we have mentioned previously that for a reversal a source must be broken but here is an important point when we combine the liquidity concepts with Market structure a liquidity sweep above the higher high is also considered a sign of possible reversal for example here we have the recent source that has broken

the market structure to the upside when price sweeps the liquidity above the recent higher high and fails to create a new high this is considered a sign of possible reversal liquidity sweep against the dominant trend is very different from liquidity sweep in the direction of the trend meaning that grabbing the liquidity above a high represents a temporary reversal but we do not expect the price to drop much a true reversal is confirmed when the price breaks and closes below the most recent origin point then we can confirm that the uptrend is truly over and the

price can continue pushing lower the same concept is true for the bearish scenario sweeping the liquidity below the latest low indicates a possible short-term reversal for the dominant downtrend from the price action view the sellers have failed to create a new low which shows momentum loss when the price immediately gets back inside the range it indicates upward momentum which has the ability to push the price to the supply level in front of the price and if the price breaks above the origin point the reversal is confirmed and we have a change of character here we

have gold in the 5-minute chart the market sentiment is bullish and the market continuously makes higher highs and higher lows these equal lows are the source of the break of structure movement and contain lots of liquidity therefore a liquidity sweep pattern formation at this level serves as a strong upward continuation signal on the contrary forming a liquidity sweep pattern above the high signals that a temporary reversal is coming this reversal is later confirmed by breaking below the recent Source Point that has led to a break of structure then we can expect the price to change

the direction and possibly continue pushing downwards practicing these Concepts on your chart will definitely improve your chart analysis help you understand the fundamentals of price movements and optimize your trade entries so guys I hope this video provided value to you if it did please go ahead and smash the like button to show your support and if you're new here consider subscribing to our Channel see you in the next episode

Related Videos

6:17

Greatest Smart Money Concepts Indicator (I...

LuxAlgo

81,607 views

14:55

Transform Your Trading with This Proven Or...

Smart Risk

84,324 views

14:26

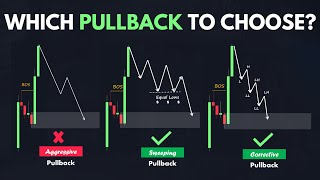

Best Pullback Trading Strategies In Forex ...

Smart Risk

521,087 views

1:10:37

WORK MUSIC - 1 Hour of Ultimate Work Music...

Deep Chill Music

210,009 views

13:39

My Incredibly Easy Scalping Strategy To Ma...

Riley Coleman

93,562 views

11:38

This Trading Tip Will Make You $$$ (Induce...

JeaFx

28,396 views

30:49

Learn ICT Concepts in 30 Minutes!

Fractal Flow - Pro Trading Strategies

1,106,371 views

18:05

Best Fair Value Gap Trading Strategy

Smart Risk

470,049 views

55:11

The ONLY Candlestick Pattern You'll EVER N...

Ross Cameron - Warrior Trading

644,435 views

39:19

Support And Resistance Didn't Work Till I ...

Rayner Teo

1,624,680 views

15:49

Best Top Down Analysis Strategy - Smart Mo...

Smart Risk

1,581,479 views

13:24

Master Multi-Timeframe Trading: Successful...

Smart Risk

78,448 views

8:24

How to Avoid False Breakouts (My Secret Te...

TradingLab

2,692,520 views

19:25

Simple 3-Step LIQUIDITY Trading Strategy

JeaFx

96,337 views

15:09

Best ICT Trading Strategy that works every...

Smart Risk

340,194 views

12:54

Best ICT Gold Trading Strategy That Works ...

Faiz SMC

271,673 views

54:56

How to Read Candlestick Patterns (with ZER...

Ross Cameron - Warrior Trading

114,905 views

18:50

Full Smart Money Trading Plan - Step by Step

Smart Risk

776,699 views

20:32

Top 4 Smart Money Concept Trading Patterns...

Smart Risk

106,879 views

32:14

The Trader Who SHOOK MARKETS With a Single...

MegaloMedia

257,379 views