I ONLY Focus on These 2 Things In Trading (2024)

735.32k views1730 WordsCopy TextShare

Umar Ashraf

#trading #stockmarket #daytrading

I use TradeZella to track and journal my trades.

https://www.trad...

Video Transcript:

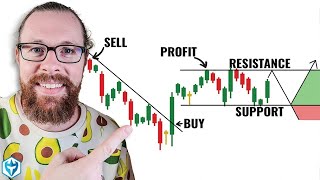

now in trading there's two different parts part one is all psychological and part two is all technical now we're not going to focus on the psychological part but we are gonna focus on the technical part today now in the technical part there's two things that we should all put all of our focus on those two things in my opinion are price action and volume we want to put all of our emphasis on price action and volume as much as possible now I see a lot of Traders when they get started they focus on indicators they'll

try to find some magic thing in the market that will tell them when to buy when to sell now I will be the first to tell you that that does not exist in the market there is no magic indicator or no magic anything but what does exist in the market is understanding who is strong is it the buyers is it the sellers who is more aggressive and the two components that we can start off on an introduction level to understand that is by focusing on price action and volume as mentioned before now if you have

so many different lines indicators and things like that on your chart just get rid of it when I first started out trading over 10 years ago my chart was filled with so many indicators so many lines on my chart and I wasn't able to identify what's a good point to enter what's a good point to exit or how I should actually manage my position and over time I realized having so many different indicators and having so many different things on my chart was actually just noise and the two things that everything boils down to is

price action and volume now I keep repeating these things because I want it to be hammered into your brain to understand that these are the two most important components of trading so now let's break down what volume is so volume is the transactions in the marketplace right so if you see something that has a volume of one that means there has been a transaction of one sale now one thing that people get very wrong about volume is they think that volume indicates there's more buyers or more sellers there's no such thing as more buyers or

more sellers in the market but what does exist is seeing more aggressive buyers or more aggressive sellers so when you see something has a volume of one that initially means that there was a buyer and a seller they agreed on a price and the transaction happened if we see volume at 10 that means 10 contracts or 10 shares or 10 whatever were transacted at one price that means 10 buyers or 10 shares from one side had to be sold and 10 shares or contracts from one side had to be bought which equate that number 10.

now what we can decipher from the volume is we can decipher if the buying side is more aggressive than the selling side that is something that we can decipher by volume a lot of Traders are they essentially overlook this part or overlooked this component of volume right now to decipher who's stronger we have something called an auction Market Theory so the mark Market is a whole auction place we have buyers and we have Sellers as mentioned trying to find an equilibrium in price on every transaction we have something that you guys have seen before where

we have the bid and we have the ask now in the bid and ask the way that works is we have people that place orders we have traders that place orders institutions that place orders when they Place orders they either hit a market order or a limit order and in the marketplace we can see this happen on level two we can see the bids we can see the ask and we can see everything being executed on time and sales now obviously if they're placing a market order to sell they're being aggressive on the buy or

sell side depending on what side the market order is going in or they're placing a limit order now when they place the limit order you start seeing that on either the bid or the ask so if a financial instrument is going higher and higher and volume is also going higher and higher that means that there is a support of interest at those buying levels or those new levels that the market is going to but imagine the price of something is going higher and higher the volume is staying flat or volume is going lower the low

volume is indicating that there's no interest at those levels but if volume keeps going higher and higher that will showcase that we are seeing interest at those particular levels so that's the basic understanding of how volume is one of the most important things which is right next to price action now as I mentioned there's a lot more to volume there's a lot more to understanding order flow there's a lot more to understanding the auction market theory that the market operates off but before we dive into that like I said let's go into the second part

which is understanding price action now to me price action has always been king that's one thing I really focus on I like to look at what price is telling me I'd like to focus on what is happening in the market what is the action that the market is showcasing me what is the accepted price that the market wants what direction is the mark going in and once again I combine that with volume as I mentioned now in price action there's a lot of different components that you guys can look at uh goes into looking at

candlesticks goes into looking at supply and demand goes into looking at support and resistance you know just putting those pieces together and the idea is to understand where the strength is to understand what areas is the market comfortable in trading right what area is the market accepting a certain price now if the market thinks that the Market's current share price or stock price or Forex price or whatever it is is that a fair value price the market will trade around those levels now there's times that that fair price will adjust due to economic news uh

due to Fed announcements due to earnings or something you know that presents in the market and that will create that imbalanced and aggressive buying and aggressive selling and sometimes we might see aggressive buyers step in and they might drive the price higher and we kind of see that on charts and seeing that on charts allows us to visualize and understand what the market is telling us right is the market actually strong is the market actually trending is the market having a strong breakout or breakdown is the market really selling off or is it just the

Trap and putting those two things together gives us a huge understanding of the Market within itself so one indicator RSI people say well if RSI is above 70 or if RSI is below 30 you should buy or you should sell whatever the case is right now what you guys have to understand is RSI is a lagging indicator which most indicators are not every single indicator but majority of indicators are lagging meaning that price has to formulate first and then the indicator follows so that makes it a lagging indicator so no matter what happens in the

market the indicator or majority of the indicators will always be behind and the two things that will be ahead is price action and essentially volume of the transactions that is happening in the marketplace so if you have indicators you have a ton of nonsense on your chart take it off and simplify your trading and like like I said Focus heavily on price action and volume and use these two things to build your trading strategies build this to build your playbooks use this to build a strong understanding of markets strong understanding of why the markets are

going up where are we seeing an imbalance in price where are we seeing an imbalance of strength in the overall market and that will help you understand everything on a much deeper level instead of you know clogging your charts out with useless data now if you are a more advanced Trader that has been trading for you know more years and understands price action volume on a deeper level like I said I will make a video on order flow how I look at the markets at a very deep level right what I'm touching right now is

just the surface level there's deeper layers in this that we want to understand that where we can really truly understand the strength the imbalances uh where real Supply is sitting where the traps is sitting where we have issues with liquidity and so on there's deeper layers that we will break down in the upcoming videos but if you are not exposed to any of this once again take a step back simplify your trading guys don't over complicate it don't go looking for any sort of crazy indicators don't draw a million crazy lines in your charts Don't

Look for Crazy chart patterns understand volume and price action combine them as later one and like I said in the upcoming weeks we will build on to layer two three and four with that being said I hope you guys found value in this video comment down below let me know what you guys use in the markets to trade what indicators you use what has worked for you maybe there is an indicator that works and I'm not exposed to it yet so I would love to hear your thoughts and with that being said I hope you

guys found value and if you did give it a thumbs up and give it a follow thank you so much and I will see you in the next video

Related Videos

14:52

The Secret To Telling Where a TRADE Will G...

Umar Ashraf

327,056 views

39:19

Support And Resistance Didn't Work Till I ...

Rayner Teo

1,866,126 views

10:35

How I Recover From Trading Losses | Step b...

Umar Ashraf

191,598 views

21:57

Stop trading Candlestick charts... Do this...

Umar Ashraf

733,931 views

55:18

How to Read Candlestick Charts (with ZERO ...

Ross Cameron - Warrior Trading

2,423,644 views

31:05

I made $21K in 32 minutes DAY TRADING my b...

Umar Ashraf

331,288 views

23:50

10 Reasons Why You're NOT Making Money Day...

Umar Ashraf

351,861 views

12:07

8 Trading Rules To Become Profitable in 20...

Umar Ashraf

327,886 views

26:30

Price Action Trading Didn't Work Till I Di...

Rayner Teo

193,793 views

19:00

Psychological Mistakes Traders Make AND Ho...

Umar Ashraf

399,044 views

51:01

Master ORDER FLOW TRADING in Less than ONE...

Fractal Flow - Pro Trading Strategies

123,839 views

16:17

7 Things I Learned From Making $15 Million...

Umar Ashraf

953,341 views

9:26

6 Things I Stopped Doing To Become A Profi...

Umar Ashraf

490,176 views

20:39

I risk $107 to make $7,500 in Trading… Thi...

Umar Ashraf

886,617 views

31:16

5 Price Action Rules EVERY Trader NEEDS To...

Thomas Wade

1,819,205 views

45:00

The Only Day Trading Strategy You Will Eve...

The Trading Channel (The Trading Channel)

5,178,440 views

10:36

I Made $137k in 9 Swing Trades... this is ...

Tori Trades

155,812 views

50:23

Options Trading For Beginners: Complete Gu...

ClearValue Tax

794,957 views

9:24

Trading Psychology is Bullsh*t... here's why.

Umar Ashraf

293,073 views

1:23:43

UMAR ASHRAF: 28 Year Old Makes $18 Million...

CEOCAST

356,032 views