What is Cryptocurrency and How Does it Work?

209.18k views2413 WordsCopy TextShare

Explains 101

Ever wondered what cryptocurrency is and why it's so popular? You’ve heard about Bitcoin, Ethereum, ...

Video Transcript:

Hey there! You’ve probably heard about cryptocurrency before. If you haven’t, you might know names like Bitcoin, Ethereum, Solana, or Dogecoin.

Yep, those are cryptocurrencies. A lot of people buy them as investments, hoping their value will go up. Some also use them as a form of money to buy and sell things.

You might have seen how the price of cryptocurrency started really low and then shot up. Some people made a lot of money, but others lost money too. That’s why some people are still unsure or even afraid of cryptocurrencies.

So, you might be wondering: what exactly is cryptocurrency? How does it work? And what do terms like “blockchain” and “mining” mean?

In this video, we’ll break down everything you need to know about cryptocurrency and how it works. Section 1. What is a cryptocurrency?

The word cryptocurrency comes from the words crypto and currency. “Crypto” means hidden or secret, referring to cryptography, a way to hide information to keep it safe. "Currency" just means money.

So, cryptocurrency is digital money that is secured by cryptography and exchanged through a computer network. Because it's digital, cryptocurrency has no physical form. You might have seen pictures of Bitcoin and thought this is what cryptocurrency looks like, but it’s not.

Cryptocurrency has no physical form as it’s all online. You can send it, receive it, and use it to buy things, just like regular money. Now, you might ask, "What’s the difference between cryptocurrency and the money in my digital wallet, like U.

S. Dollars or Euros in my mobile banking app? " Well, traditional currencies like the U.

S. Dollar and Euro are controlled by central banks. To send those currencies, you need a bank or payment service.

But with cryptocurrency, you can send money directly to your friend without needing a middleman like a bank. But wait, why doesn't cryptocurrency need a bank? Here’s a bit of history.

Cryptocurrency’s modern story began with Bitcoin, which was created in 2009 by an anonymous person known as Satoshi Nakamoto. He seems Japanese and you will see this Japanese guy face that most people assuming is him because his name and background seems true, but actually nobody knows who he is. Unlike traditional currencies like U.

S. Dollar and Euro that are printed and controlled by central banks or governments, cryptocurrency was created to be free from control. Some people didn’t like the idea of governments controlling money, so they made cryptocurrency as a way for people to exchange money directly with each other without needing a bank or any central authority.

So, cryptocurrency is actually money? And not investment like stock? Well yes, cryptocurrency was actually made to be used as money, like the U.

S. Dollar – for buying, selling, sending, and receiving money. Over time, however, cryptocurrency became more like an investment.

In some countries, like El Salvador, people still use cryptocurrency to buy things in everyday life, but most people use it to try to grow their money. For example, you might buy Bitcoin when it’s worth $10,000 and sell it when it’s worth $60,000 to make a profit. Most people don’t want to use cryptocurrency as currency due to its volatility, like buying a coffee for 0.

001 Bitcoin today, but tomorrow you might need to pay 0. 002 Bitcoin for the same coffee because of its fast price changes, making it unpredictable. This made most people still prefer to use traditional currency as money and cryptocurrency as investment.

Cryptocurrency started with Bitcoin, but now there are many other coins like Ethereum, Tether, and even meme coins. So, that’s a simple definition and a bit of history about cryptocurrency. Let’s move on to the next section.

Section 2. How does a cryptocurrency work? Cryptocurrency works using a technology called blockchain.

So, what is a blockchain? Imagine Bob has a notebook where every transaction is written down. Once a transaction is written, it’s locked in and can’t be erased or changed.

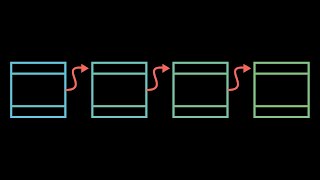

Now not only Bob has the notebook, but everyone in this blockchain network has a copy, so no one can cheat or mess with it. If Bob hacks and changes the notebook, it will be obvious as it’s different from other’s notebook and that notebook will be invalid. Each page in the notebook is a block in blockchain, and when one block is full, a new one is added to the chain.

That’s why it’s called blockchain which is a chain of blocks! So, how does cryptocurrency use blockchain technology? When a new transaction is made, the transaction details are sent to a network of computers around the world that are using the blockchain.

These computers then check if the transaction is valid by solving a very hard puzzle or equation. Once they solve the puzzle and confirm that the transaction is correct, the information is added to several blocks. These blocks are linked together, making the data permanent and unchangeable.

Once that’s done, the transaction is successful. In regular transactions, like sending U. S.

Dollars or Euros, a bank validates and processes the transaction. But with cryptocurrency, it’s these computers around the world that validate it by solving hard puzzles and equations. Now, you might wonder, who are these computers solving the puzzles?

Well, people who solve puzzles and validate the transaction are called miners. Why they do that? When they solve the puzzles or equations, the cryptocurrency system rewards them with new coins.

This is called mining, and based from the system called proof-of-work. That’s why you may have heard about Bitcoin miners using powerful computers, because they want to solve as many puzzles as they can. The more puzzles they solve, the more cryptocurrency they earn.

Not all cryptocurrencies are mined this way. Some, like Ethereum now, use a different method called proof-of-stake, which I will explain in another video. Section 3.

Cryptocurrency as an investment. Now, here’s the juiciest part, is cryptocurrency a good investment? Well, the answer depends.

Some people have made a lot of money by buying crypto when the price was low and selling it when the price went up. For example, if you bought Bitcoin in 2016 when it was around $500 per coin, and sold it in 2024 when it hit $60,000, you would have made a 13,000% return! That kind of return sounds like a dream to many professional investors.

But, like any investment, big return also means big risk. Cryptocurrency is very volatile, meaning its price can go up and down very quickly. For example, if you bought Bitcoin at $45,000 in May 2022, then saw it drop to $16,000 by December 2022, if you sold it, you would have lost 65% of your money.

Then, it rose again to $70,000 in 2024. This doesn’t just happen with Bitcoin, it happens with most cryptocurrencies because their prices are so unstable. So, you might ask, "Why is cryptocurrency so volatile?

" Crypto volatility comes from several factors, including supply and demand, market sentiment, regulation changes, technological development, market manipulation, and even more. However, the biggest drivers are speculation and media hype. Many investors buy cryptocurrencies hoping to make quick profits.

They often chase trends and popular narratives without fully understanding the asset. For example, when the media announced that ProShares released the first Bitcoin ETF, and the price of Bitcoin soared to $65,000 as excitement grew among investors. However, if investors start to doubt a cryptocurrency’s future, they may panic and sell off their holdings, leading to sharp price drops.

For instance, when China announced a ban on cryptocurrency, the price of Bitcoin dropped to $29,000 as uncertainty about its future spread. And that’s why cryptocurrency market is hard to predict. Section 4.

Another terms in cryptocurrency. We have talked about blockchain and mining, now let’s go over some other common terms that you may see a lot in cryptocurrency. First is Bitcoin.

Bitcoin is the first and most well-known cryptocurrency. It’s often called digital gold because it was the original and is still the most valuable. Bitcoin’s supply is limited, which can make it more valuable over time.

Second is Altcoin. An altcoin, short for “alternative coin,” refers to any cryptocurrency that’s not Bitcoin. Examples include Ethereum, Solana, and more.

There’s also a type of altcoin called meme coins, like Dogecoin or Shiba Inu. So, altcoins are all cryptocurrencies other than Bitcoin. Third is a wallet.

A cryptocurrency wallet is different from a regular wallet that holds your cash. A crypto wallet doesn’t actually store your cryptocurrency. Why?

Because cryptocurrency is always on the blockchain. What a crypto wallet does is store your public and private keys. There are two types of wallets: hot wallets and cold wallets.

Hot wallets store keys online, making them easily accessible, but they are also more vulnerable to hacking. On the other hand, cold wallets store keys offline, like on a hard drive. This type is safer but less convenient.

Also, if you lose your hard drive, you could lose your crypto too! For example, a guy named James Howells had his ex accidentally throw away his hard drive that contained private key to 8,000 Bitcoins. He’s still trying to find it in the landfill to this day.

What a poor guy! Fourth is keys. As I mentioned before, a cryptocurrency wallet contains two types of keys: the private key and the public key.

The public key is like your wallet’s address, people can use it to send you cryptocurrency. While the private key is more like a password, it proves that you own the cryptocurrency in your wallet. You can share your public key to anyone but you must keep your private key secret.

Fifth is Fork. A fork happens when a cryptocurrency splits into two versions. This happens when the community disagrees on how the cryptocurrency should be run or improved.

For example, Bitcoin forked to create Bitcoin Cash because some wanted to make transactions faster by increasing the Bitcoin’s block size, while others disagreed. Those who agreed with the changes moved to Bitcoin Cash, while those who preferred the original approach stayed with Bitcoin. Section 5.

Pros and cons of cryptocurrency. Of course, as you know cryptocurrency has its pros and cons. Let’s talk about the advantages of cryptocurrency.

The first advantage is decentralization. This means no single authority, like a central bank, can control cryptocurrency. Unlike traditional currency, the government can’t control or set the value of cryptocurrency.

The second advantage is accessibility. Cryptocurrencies can give financial access to people without a bank. If you need to go to the bank to register your account, wait a long line and do lots of paperwork, cryptocurrency make it much simpler.

Anyone with an internet connection can participate without any complicated application process. The third advantage is that cryptocurrency is flexible. You can send money to anyone, anywhere, anytime.

Crypto operates 24/7 without any breaks. You can transfer money quickly across the world without needing a bank, and with much lower fees. The fourth advantage is privacy.

Most cryptocurrencies offer more privacy than traditional banks because your transaction data is encrypted and harder to trace. However, this data is still stored on a public blockchain, meaning it’s not completely secret as some believe. Others, especially governments and IRS, can still track your transactions if they investigate deeply enough, although it’s more difficult.

While extra privacy is good, it can also cause problems, which we’ll discuss soon. The fifth advantage is, of course, the potential for high returns. Many people invest in crypto for the chance of making big profits.

Coins like Bitcoin and Ethereum have increased in value by hundreds of percent per year. Imagine buying Dogecoin and getting a 600% return in just three months! Not even Warren Buffett can beat that.

But of course, this isn’t all good, because now we’ll move on to the next part, which is. The disadvantages of cryptocurrency. The first and biggest disadvantage is volatility as crypto prices can swing wildly.

If you think stocks are like a roller coaster, then crypto is like that but much more intense. For example, Dogecoin shot up in value and then dropped just as quickly in just 1 year. So, you could be rich and poor in the same year.

The second disadvantage is illegal transaction. As I mentioned earlier, cryptocurrency offers a lot of privacy. But this same privacy makes it a hot spot for criminals who want to do illegal transactions or launder their money.

Because cryptocurrency transactions are harder to trace, criminals use crypto to move money and avoid detection by authorities. The third disadvantage is regulation uncertainty. Since governments can’t control cryptocurrency, the government are not so happy with that, and they will not just stand silent about that.

The government are still trying to figure out how to regulate cryptocurrency. This could change how crypto is used in the future. In fact, cryptocurrency regulation has become a hot topic in the 2024 U.

S. Presidential election. The fourth disadvantage is scams.

One of the schemes is the scammer will show you a fake crypto website. Then they lure you to buy and invest in that cryptocurrency with fake promise return. In the end, you can’t withdraw your money, leaving you stuck.

The other scheme is scammer might ask you transfer some coins like the classic scam scheme, once you transferred any cryptocurrency to the scammer, the crypto can’t be reversed. Why? We will talk about it in the next section.

The fifth disadvantage is lack of consumer protection. As I mentioned before, cryptocurrency isn’t managed by any one person or institution. This can be a good thing, but it also means that when something goes wrong, there’s no one to help.

If you have a problem with a normal USD transaction, the bank can help you get your money back. But, as no one can control cryptocurrency, so once you transferred your cryptocurrency to other, the transaction is irreversible. So, in conclusion, cryptocurrency offers exciting opportunities for those willing to learn about its potential.

And then your next question, should you use cryptocurrency? The answer depends on you. Remember!

Don’t rely solely on this video to decide! If you want to use cryptocurrency, it’s important to do your research first, and don’t fall into FOMO by jumping in without knowing what you’re doing. It's important to understand the risks before diving in!

If you want me to make other videos explaining these topics, please like and subscribe. Thanks for watching.

Related Videos

25:16

But how does bitcoin actually work?

3Blue1Brown

16,872,935 views

17:34

Explained | The Stock Market | FULL EPISOD...

Netflix

16,126,053 views

25:47

Harvard Professor Explains Algorithms in 5...

WIRED

3,956,659 views

23:25

Where Did Bitcoin Come From? – The True Story

ColdFusion

2,726,656 views

4:30

How does the stock market work? - Oliver E...

TED-Ed

11,335,623 views

13:01

Has Trump damaged the dollar?

The Economist

174,934 views

42:27

Cryptocurrencies - The future of money? | ...

DW Documentary

958,120 views

37:40

Jamie Dimon urges US to engage with China ...

Financial Times

441,711 views

20:18

Money’s Mostly Digital, So Why Is Moving I...

Wendover Productions

3,412,256 views

7:03

Blockchain In 7 Minutes | What Is Blockcha...

Simplilearn

3,417,609 views

15:12

Mutual Funds vs Index Funds vs ETFs vs Hed...

Explains 101

53,702 views

19:47

What is Crypto and How to Keep it Safe? | ...

TaiwanPlus News

190 views

18:19

What does Palantir actually do?

Good Work

2,090,436 views

38:03

Doug Ford and Trump’s Bad Poker Hand | The...

The Atlantic

219,986 views

1:21:01

How To Invest In Crypto Complete Beginner'...

Brian Jung

2,335,945 views

23:20

Treasury Secretary Scott Bessent talks tar...

Yahoo Finance

152,164 views

13:25

Is Trump right about China manipulating it...

CBC News

1,012,261 views

52:36

Cardano founder Charles Hoskinson talks bi...

CNBC International

10,458 views

9:44

How Banks Magically Create Money

Primal Space

1,408,328 views

20:36

The Psychology of Money in 20 minutes

Escaping Ordinary (B.C Marx)

4,898,266 views