Why it’s hard for Americans to retire

781.35k views1586 WordsCopy TextShare

Vox

There’s a reason so many of us don’t have enough retirement savings.

Subscribe to our channel and t...

Video Transcript:

[Music] a lot of people ask me how do they know if they're on track to be ready for retirement if you want to maintain your living standards that you have now or you'll have throughout your life in the American system by the time you're 30 you should have about one times your current salary by the time you're 40 you should have about 2 and 1 half or three times your salary in your 60s you should have 8 to 10 times your annual salary what's your reaction to that you can see me laughing because who could

save that much I'm sorry I think those numbers are very abstract okay all right so I have some work to do and the reason I'm wincing when I say these numbers is that I know that Real Americans just don't have it the math of what you're supposed to have and what people actually do have is a huge gap at the median people have saved approximately $45,000 that means half the population has saved less than $45,000 and that also means that there's quite a few people that haven't saved anything what is your work status right now

retired totally retired I was a nurse my income was probably 100,000 120,000 around there retirement is probably around the same thing so my annual income is 140,000 I lived in the UK for 6 years our retirement savings was put into a pension now it's about 15 to 16,000 in my current job putting away um for my 401k and putting a little bit aside um for a Roth IRA with the playwriting I can make between $4 and $50,000 but often I make zero buus the professor job I make about 135 so that's not bad and then

in savings I have about A4 million there which isn't so bad plus I have a TIA C if I keep working for a few more years it'll get to a half million so I'm close actually now now that I think about it I earn $15,000 a year so right now I only have two plans as far as I know I have the one for my first job my 401k and the one for my current uh my current job which is a pension the reason why a coal miner and a lawyer could expect to retire is

because of the design of our pension system which we don't have anymore your employer would put money aside for your retirement and that money couldn't be accessed by you so the dollar that the employer put in on your behalf was put into a big pool of money and it was professionally invested and at the end of your working life that money would be translated into a lifetime benefit we we had unions negotiating and then that all changed about 40 years ago we changed the federal pension laws so you had the traditional pension becoming less attractive

to employers at the same time at the end of the 1970s Congress passed a law that allowed people to effectively make a choice whether they want to receive some of their wages as wages or defer those wages into a savings program we now call it a 401k it was supposed to be a secondary savings system for mainly higher income people in big firms a 41k plan is sponsored by an employer so it's tied to your job your employer can make contributions or you can make contributions and what you receive at retirement is what you've saved

into that individualized account an individual retirement account is just for individuals and it's only funded by individuals at the same time worker power decreased I'm talking to you in 2024 half of the people are covered by retirement plan but the vast majority that if they have a retirement plan are covered by 401K the American system just breaks down on on the three basic Design Elements and the first one the most important one is that we don't have universal access half of workers don't have a way to save for retirement and that means they miss out

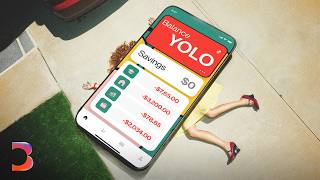

on all that accumulated saving every other country who is our peer have automatic enrollment in a pension plan different ways you're in a union or you're in a government plan whatever the detail that matters is that you're automatically enrolled and everybody who works gets access to it this episode is presented by Metro by T-Mobile this tax season Metro wants to help customers avoid wasting dollars by using their tax refunds to catch up on things that they want not on things they don't according to Metro you don't take yata in life so don't take yata from

your wireless provider Metro by T-Mobile has no contracts no credit checks and no surprises Metro does not influence the editorial process of our videos but they do help make videos like this possible to learn more you can stop by one of over 6,000 metro stores nationwide now back to the video not all of us have training to be a professional investor and it shows how to set up a retirement account um how much money to put in it when should you make those contributions should you do it every week or once a year and then

where are you going to invest that money there are literally thousands of investment choices U within an individual retirement account if you open it at a mainstream financial institution that's why the money is sitting in a savings account because I don't know what percentage is supposed to be in the stock market or a Roth or any of that usually whenever I start a job if there was a retirement option there is someone who is a specialist who could give advice but usually it would be either uh co-workers or doing my own little research to see

what I think is best for me I navigated my 20s and and my finances pretty much in a vacuum and I made some mistakes and you know stumbled along the way I think that's really the key difference U what other societies have learned versus the experience in the United States Investments are chosen for you the point is that if you don't want to educate yourself and some people do but if you don't choices will be made for you to make it easy to save the United States unlike every other country that has their workers accumulate

money for their retirement we let people take money out having to dip into it all the time because I was paying two mortgages was very difficult because I feel like it wiped me out between the ages of 22 and 26 wasn't thinking about what was I going to need at 68 when I was just trying to pay my rent often times when I would leave one job the little bit of um money that I had in a 401 that can be used to pay off a credit card debt or used to help me pay um

pay down a student loan when you need money you don't care that this might be earmarked for your retirement if you have a crisis today you need to take care of that crisis and that's like just a basic violation of design long-term savings should be attached to long-term accounts and to Safe accounts what people want the most is a time where they can control the the pace and content of their time while they're still healthy and people want to pay for it when they're working but they want to look forward to that time I go

to senior centers and do different things sewing I'm learing to crochet Dance I'm sort of fixated on retiring uh it's kind of all I think about I guess I plan on working in a bookstore and uh going to a lot of baseball games there are social Assistance programs and income programs however for a lot of folks who might have been earning a certain amount of money could very well mean that they are not going to receive that kind of money in retirement and so they might need to go to other sources such as living with

family or relying on the kindness of others or charity I can see myself maybe wanting to do like part-time engineering I don't know maybe I'll double down into my creativity I know I would like to keep busy yeah so I'll figure it out if you're 40 put a whole bunch of money in that account if you're 19 just start saving 5% but it's got to be protected from your your younger self I would love to teach I would love to do charity work I would love to probably retire in my early 60s gives me another

30 years to worry about how am I saving for retirement I hope that's enough time I hate to say you have to have or you should have a certain multiplier of your salary at a particular age I think the important thing is to keep contributing and take advantage of employer matches and do the best you can given your circumstances because that's really what the research shows that you do better when you consistently over time a period of decades really make [Music] contributions

Related Videos

8:13

Is the US running out of Social Security?

Vox

875,838 views

9:29

Why A $100,000 Salary Can’t Buy The Americ...

CNBC

1,576,902 views

15:22

Something Terrible Is Happening To Boomers

Vincent Chan

1,478,366 views

10:12

How To Retire a Few Decades Early | Pete A...

TEDx Talks

141,745 views

13:27

How Trump’s second term will be different

Vox

3,530,446 views

16:23

Is it worth having kids?

The Economist

2,371,608 views

17:04

Real Estate Expert Answers US Housing Cris...

WIRED

1,222,777 views

6:37

The idea that you could work longer if you...

CNBC Television

264,237 views

9:50

Why Americans Can’t Keep Their Paychecks

CNBC

629,845 views

11:31

Why Young People Are in So Much Debt

Bloomberg Originals

208,859 views

18:26

Why The U.S. Won’t Do Away With Tipping

CNBC

1,087,652 views

3:53

For many American seniors, their retiremen...

CBS Evening News

197,973 views

12:19

South Korea’s Radical Solution to Asia’s B...

Bloomberg Originals

286,684 views

52:25

Why Americans Feel So Poor | CNBC Marathon

CNBC

3,188,873 views

21:13

If you're in your 50s or 60s, watch this. ...

Streamline Financial

1,009,834 views

27:09

America Has a Retirement Problem, Ghilardu...

Bloomberg Television

160,397 views

6:30

How to Get By on Less Than $1 Million in R...

WSJ News

54,755 views

1:31:43

The Economic Theory That Explains Why Amer...

New York Times Podcasts

242,278 views

15:36

How the UK is becoming a ‘third-world’ eco...

CaspianReport

2,758,653 views

54:57

Can You Afford to Retire? (full documentar...

FRONTLINE PBS | Official

1,449,962 views