William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

12.41M views11851 WordsCopy TextShare

Big Think

Everything You Need to Know About Finance and Investing in Under an Hour

Watch the newest video from...

Video Transcript:

Hi, I'm Bill Ackman. I'm the CEO of Pershing Square Capital Management and I'm here today to talk to you about everything you need to know about finance and investing and I'm going to get it done in an hour and you’ll be ready to go. How to Start and Grow a Business So let’s begin. We’re going to go into business together. We’re going to start a company and we’re going to start a lemonade stand and now I don’t have any money today, so I'm going to have to raise money from investors to launch the business. So

how am I going to do that? Well I'm going to form a corporation. That is a little filing that you make with the State and you come up with a name for a business. We’ll call it Bill’s Lemonade Stand and we’re going to raise money from outside investors. We need a little money to get started, so we’re going to start our business with 1,000 shares of stock. We just made up that number and we’re going to sell 500 shares more for a $1 each to an investor. The investor is going to put up $500. We’re

going to put up the name and the idea. We’re going to have 1,000 shares. He is going to have 500 shares. He is going to own a third of the business for his $500. So what is our business worth at the start? Well it’s worth $1,500. We have $500 in the bank plus $1,000 because I came up with the idea for the company. Now I'm going to need a little more than $500, so what am I going to do? I'm going to borrow some money. I'm going to borrow from a friend and he’s going to

lend me $250 and we’re going to pay him 10% interest a year for that loan. Now why do we borrow money instead of just selling more stock? Well by borrowing money we keep more of the stock for ourselves, so if the business is successful we’re going to end up with a bigger percentage of the profits. So now we’re going to take a look at what the business looks like on a piece of paper. We’re going to look at something called a balance sheet and a balance sheet tells you where the company stands, what your assets

are, what your liabilities are and what your net worth or shareholder equity is. If you take your assets, in this case we’ve raised $500. We also have what is called goodwill because we’ve said the business—in exchange for the $500 the person who put up the money only got a third of the business. The other two-thirds is owned by us for starting the company. That is $1,000 of goodwill for the business. We borrowed $250. We’re going to owe $250. That is a liability. So we have $500 in cash from selling stock, $250 from raising debt and

we owe a $250 loan and we have a corporation that has, and you’ll see on the chart, shareholders’ equity of $1,500, so that’s our starting point. Now let’s keep moving. What do we need to do to start our company? We need a lemonade stand. That’s going to cost us about $300. That is called a fixed asset. Unlike lemon or sugar or water this is something like a building that you buy and you build it. It wears out over time, but it’s a fixed asset. And then you need some inventory. What do you need to make

lemonade? You need sugar. You need water. You need lemons. You need cups. You need little containers and perhaps some napkins and you need enough supplies to let’s say have 50 gallons of lemonade in our start of our business. Now 50 gallons gets us about 800 cups of lemonade and we’re ready to begin. Let’s take a new look at the balance sheet. So now we’ve spent $500 on supplies. We only have $250 left in the bank, but our fixed assets are now $300. That is our lemonade stand. Our inventory is $200. Those are the supplies and

things, the lemons that we need to make the lemonade. Goodwill hasn’t changed at 1,000, so our total assets are $1,750 and we still owe $250 to the person who lent us the money. Shareholder equity hasn’t changed, so we haven’t made any money. All we’ve done is we’ve taken cash and we’ve turned it into other assets that we’re going to need to succeed in our lemon stand business. So let’s make some assumptions about how our business is going to do over time. We’re going to assume we’re going to sell 800 cups of lemonade a year. That’s

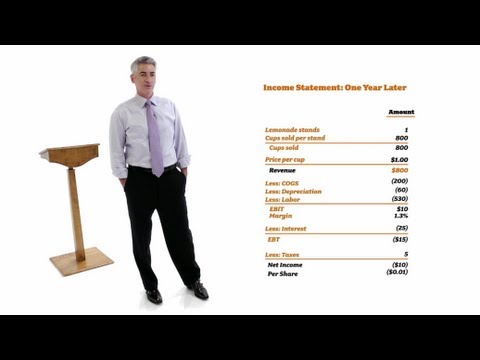

not a particularly ambitious assumption, but we should assume the lemonade business is fairly seasonal. Most of the lemonade sells will happen over the summer. We’re going to assume that each cup we can sell for $1 and it’s going to cost us about $530 per year to staff our lemonade stand. So now let’s take a look at the income statement, so the income statement talks about the profitability, about the revenues that the business generated, what the expenses are and what is left over for the owner of the company. So we’ve got one lemonade stand. We’re selling

800 cups of lemonade at our stand. We’re charging $1, so we’re generating about $800 a year in revenue and we’re spending $200 on inventory. There is a line item here called COGS. That stands for cost of goods sold. We have depreciation because our lemonade stand gets a bit beat up over time and it wear out over five years, so it depreciates over 5 years. We’ve got our labor expense for people to actually pour the lemonade and collect cash from customers and we have a profit. We have EBIT and that is earnings before interest and taxes,

of $10. That is kind of our pretax profit for the business. We didn’t make very much money because you take that pretax profit of $10 and you compare it to our revenues. It’s about a 1.3% margin. That is not a particularly high profit. Now we’ve got to pay interest on our debts and we have a loss of $15 and then we don’t have any taxes, but at the end of the day we still lose money. So the question is, is this a particularly good business? Well we’re losing money and our cash is basically going down

over time. Is this a business we want to stay in? Now the cash flow statement takes the income statement and figures out what happens to the cash in the company’s till, so when you put up $750, some money goes to pay for a lemonade stand. Some money is lost selling the product and at the end of the day we started with $750 and now we only have $500. Let’s look at the balance sheet. What has happened? Our cash has gone down from 750 to 500. Our fixed assets have gone from 300 to 240. That means

our lemonade stand is starting to wear out. Goodwill hasn’t changed. We still owe $250 and our shareholder’s equity is now down to $1,490, so it was the 1,500 we started with minus the $10 we lost over the course of the year. So should we continue to invest in the business? We’ve lost money in the first year. Is it time to give up? Well let’s think about it. Let’s make some projections about what the company is going to look like over the next several years. Let’s assume that we take all the cash the business generates and

we’re going to use it to buy more lemonade stands so we can grow. Let’s assume we’re not going to take any money out of the company and we’re not going to pay a dividend. We’re going to keep all the money in the company and reinvest it. Let’s assume that we’re going to—as we build our brand we can charge a little more each year, so we’re going to raise our prices about a nickel, five cents more for each cup of lemonade each year and then we’re going to assume we can sell 5% more cups per stand

per year. So we’ve got built in growth assumptions. Now let’s take a look at the company. So if you take a look at this chart you’ll see in year one we started out with one lemonade stand. We add one a year and then by year five we’re up to seven because we’ve got a big expansion plan. Our price per cup goes up a nickel a year and our revenue goes from $800 and starts to grow fairly quickly and the growth comes from increased prices for cups of lemonade and it also comes from opening more stands.

So by year five we have almost $8,000 in revenue. Our costs are relatively constant, which is the lemonade and the sugar. That’s about $1,702. We have depreciation as more and more stands start to wear out over time. We’ve got labor expense, but by year five the business is actually doing pretty well. We went from a 1.3% margin to over a 28% margin. The business is now up to scale. We’re starting to cover some of our costs. We’re growing. We’re still paying $25 a year in interest for our loan and we have earnings before taxes, after

interest of $2,300 by the end of year 5. So we put $500 into the business. We borrowed 250 and by year five we’re making a profit of $2,300. That sounds pretty good. Now we have to pay taxes to the government. That is about 35% and we generate net income or another word for profits of $1,500 by the fifth year and about a dollar a share. So if you think about this our friend put up $500 to buy 500 shares of stock. He paid a dollar and after five years if our business goes as we expect

he is actually making a dollar a share in profit. That sounds like a pretty good deal. So what has been the growth? The growth has been fairly dramatic over the period and that is what has enabled us to become a successful business. Now these are just projections, but if they’re reasonable projections this might be a business that we want to start or invest in. Now let’s look at the cash flow statement. So as the business becomes more and more profitable we generate more and more cash and the cash builds up in the company. We go

from $500 of cash in the company to over $2,000 of cash over the period. The balance sheet, again, the starting balance sheet had shareholder’s equity of $1,490, but as the business becomes more profitable the profits add to the cash. They add to the assets of the company. Our liabilities have not changed and the business continues to build value over time. So again by the end of year five we’ve got $4,000 of shareholder equity and that’s almost three times what it was when we started. Good vs. Bad Businesses Now is this a good business or a

bad business? How do we think about whether it’s good or bad? One thing to think about is what kind of earnings are we achieving compared to how much money went into the company. Now this is a business that we valued at $1,500 when we started. Someone put up $500 for a third of the company. We gave it a $1,500 value. By the end of year five it’s earning over $1,500 in earnings, so that’s over a 100% return on the money that we put into the company. That’s actually quite a high number. We spent—let’s talk about

return on capital. We’ve spent $2,100 in capital building lemonade stands and we earned $2,336 in year five on the capital we invested. That’s over 100% return on capital. That is a very attractive return. Earnings have grown at a very rapid rate, 155% per annum. This is really a growth company and our profitability has gone from 1.3% to 28.6% by year five and that sounds pretty attractive and it is. So let’s look at the person who put up the loan. Well that person put up $250 and the business has been profitable. We’ve been able to pay

them their interest of 10% a year, $25 a year and they’re happy because they put up $250. They’re getting a 10% return on their loan and the business is worth well more than $250. We’ve got more than that in cash. As a result, they’re in a safe position, but they’ve only made 10% on their money. Now let’s compare that with the equity investor, the person who bought the stock in the company. That person earned a dollar a share in year five versus an investment of a dollar a share, so he is earning over 100% or

about 100% return on his investment versus only 10% for the lender. So who got the better deal? Well obviously the equity investor. Now why did the equity investor, why do they have the right to earn so much more than the lender? The answer is they took more risk. If the business failed the lender is entitled to the first $250 of value that comes from liquidating the company, so if you sell off the lemonade stands and you only get $250 the lender gets back all their money. They’re safe. They got their 10% return while the business

was going. They got back their $250, but the equity investor, the person who bought the stock is wiped out because they come after the lender. So what is the difference between debt and equity? Debt tends to be a safer investment because you have a senior claim on the assets of a company and it comes in lots of different forms. You’ve heard of mortgage debt on a home. That’s a secured loan secured by a house, but you could have mortgage debt on a building for a company. There is senior debt. There is junior debt. There is

mezzanine debt. There is convertible debt, but the bottom line, it’s all debt. It comes in different orders of priority in a company and the rate your charge is inversely related to your security, so the better the security and the less risk the lower the interest rate you’re entitled to receive. The more junior the loan the higher the interest rate you’re entitled to receive, but you can avoid the complexity. All you need to think about is debt comes first. It’s a safer loan, but you’re profit opportunity is limited. Now the equity also has their varying forms.

There is something called preferred equity or preferred stock. There is common equity or common stock and again stock and equity are basically synonyms. They’re options, but really not worth talking about today. The important point is that equity gets everything that is left over after the debt is paid off, so it’s called a residual claim. Now the good thing about the residual claim is that business grows in value if you don’t owe your lender anymore, but all that value goes to the stock holder. So the question is why was the lender willing to take only a

10% return when the equity earned a much higher rate of return and the answer is when the business started there was no way of knowing whether it would be successful or not and the lender made a bet that if the business failed they could sell off the lemonade stand. It cost $300 to make it. They would have some lemons, some lemonade. Even if they sold it at a much lower price than the dollar they originally projected the lender felt pretty comfortable that they would get their money back, whereas the stockholder is really taking a risk.

They were betting on the profitability of the company and they were taking a risk that if it failed they would lose their entire investment, so they were entitled to get a higher return or have the potential to have a higher return in the event the business we successful. So let’s talk about risk. Lots of different ways people think about risk, but the one that we think is the most important—you know a lot of people talk about risk in the stock market as the risk of stock prices moving up and down every day. We don’t think

that’s the risk that you should be focused on. The risk you should be focused on is if you invest in a business what are the chances that you’re going to lose your money, that there is going to be a permanent loss. When you’re thinking about investing your own money, when you’re thinking about one investment versus another don’t worry so much about whether the price moves up and down a lot in the short term. What matters is ultimately when you get your money back will you earn a return on your investment. How do you think about

risk? Well one way to think about risk is to compare your risk to other alternatives, so you could buy government bonds and government bonds are considered today the lowest risk form of investment and the US Treasury issues 10 year, 3 year, 5 year debt. There is a stated interest rate and today a 10 year Treasury you earn about a 3% return. So you give your government $1,000 and you get $30 a year in interest. At the end of 10 years you get your $1,000 back, so that’s very, very safe and that sort of provides a

floor. Now obviously if you’re going to make a loan you can lend money to the government and earn 3%. Well if you can lend money to a lemonade stand you want to earn meaningfully more, so in this case the lender is charging a 10% rate of interest. Why 10%? Because they want to earn a nice fat spread over what they can make lending to the government because a startup lemonade stand business is a higher risk business. Equity investors sort of think about things similarly, so the higher the valuation—the more risky the business the higher the

rate of return the equity investor is going to expect and the lower the risk business the lower the return the equity investor is going to expect and equity investors don’t get interest the same way a lender does. What equity investors get is they get the potential to received dividends over the life of a company. Let’s talk about raising capital. You started this lemonade business. Now the point of this was to make money in the first place. The business is doing very well yet I, having started the business coming up with a name and the concept,

hired all the people, I've made nothing, right. So the business has grown in value, but where is my money? I need money to buy a car for example, so I want to buy a car for $4,000. What are my choices? What can I do? Well we’ve taken all the cash the business has generated. We’ve reinvested it in the business. Now the good news is we’ve taken all that money. We’ve been able to use it to buy more lemonade stands and these lemonade stands are more and more productive and it’s grown the value of the business

faster and faster. Now my alternatives could included instead of growing the business so quickly, instead of investing in more lemonade stands I could simply have paid dividends to myself. Now the good news about that is I get money along the way, but the bad news about that is the business wouldn’t grow as quickly and if you have a business as profitable as this lemonade stand company and you just open a new lemonade stand and people earn—we can earn hundreds of dollars in each new stand it makes sense to keep investing. Well how do I keep

my business going and growing, taking advantage of the opportunities, but take some money off the table? How do I do that? Well I could sell the company, so I could sell my lemonade stand business. I started this one in New York. Maybe there is someone in New Jersey who wants to buy me, consolidate with my lemonade stand company. Well the problem with that is once I sell it I can no longer participate in the opportunity going forward and I believe in this business. I think it’s going to be very successful over time. So that’s one

alternative. The other alternative is I could pay a dividend. We have by year five, over $2,000 sitting in the bank, so I could pay that money out to the shareholders of the company, but that would really slow my rate of growth going forward because I couldn’t afford to build and buy more lemonade stands and it’s not the $4,000 that I need in order to raise money. So I'm going to look at taking a business public. What does that mean? Well first of all, before we take our business public we want to think about what it’s

worth. It’s year five. We’ve been doing a good job. We’ve got a business that is profitable. Everything seems to be going well. Well the problem is I've got some personal needs. I've started this company. I've taken all the cash the business generates. I've reinvested the cash in the business. I bought more and more lemonade stands. The growth is accelerating. I feel great about it, but I need money. How do I get money? What do I do? Well I've got a company that generates a lot of cash each year, but I've been reinvesting the cash, so

one alternative is perhaps I don’t grow as quickly. I don’t buy as many lemonade stands and I start sending that money back to me in the form of a dividend. So each year I pay out some amount of cash in the company. My need is really greater than that. There is only about $2,000 in the company today. If I sent that out that is half of what I need to by a car. So how do I get the rest of the money or how do I get more money? Well I could sell the company, so

that’s one alternative, but the problem there is I've got this really good business. It’s growing really quickly. Why would I want to get rid of it at this point? So what should I do? The other alternatives, other than selling 100% of the business is to sell a piece of the business and I can do that privately. I can find an investor who wants to buy a private interest in the company and if the business is worth enough I can sell them a piece of the business and we can be successful. The other alternative is I

can take the business public. Everyone has probably heard of an IPO, an internet company is going public, people getting rich on an IPO. What is interesting is an IPO doesn’t make someone rich. All it really does is it takes a business that they already own and it sells a piece of it to the public and it gets listed on an exchange like the New York Stock Exchange. An IPO, the abbreviation stands for initial public offering and it’s initial because it’s the first time a company is going public. Going public means you’re selling stock to the

broad general public as opposed to finding one investor buying interest in the company and its offering because you’re offering people the opportunity to participate and the way to do that actually is you get a good lawyer. You get a good bank, investment bank. It’s going to be your underwriter and you’re going to put together a document called a prospectus, which is going to talk about all the risks and the opportunities associated with investing in your company. It’s going to have history of how the business is done over time. It’s going to have the balance sheet

that we talked about. It’s going to have income statements from the previous several years. It’s going to have cash flow statements and investors are going to read that document and they’re going to learn about whether this is a business they want to invest in and how to think about what price they want to pay for it. When you decide you want to take your business public you’re going to have to reveal a lot of information to the public in order to attract investors to participate and the Securities and Exchange Commission they’re going to study this

prospectus very carefully. They’re going to make sure that you disclose all the various risks associated with investing in the company and you’re also going to have an opportunity to talk about the business. It’s some combination of a marketing document as well as a list of the appropriate risks that people should consider before buying stock in the company. That takes time to prepare. It costs money to prepare. You’re going to need good lawyers. You’re going to need a good investment bank and you’re going to go through a process where you’re going to make a filing with

the FCC with a copy of the initial what’s called registration statement for the offering or the prospectus. The FCC is going to comment on it and eventually you’re going to have a document that you can then sell shares to the public. That is kind of an exciting time for you because when you sell shares to the public that’s really, in most cases, the way to get the optimally high price for the company, but you don’t have to sell 100% of the business to the public. In fact, typically you only sell a small percentage. You get

to keep the rest. You get to keep control of the company, but you get to raise money in the offering and you can use that money to buy the car that we were talking about before. Now before you decided to go public or even to sell it at all it’s probably a good idea to figure out what the business is worth. So let’s talk about valuation or how to value a business. One way to think about the value of your business is to compare it to other similar businesses. Now the stock market is actually a

pretty interesting place to look. Now the stock market is a list of companies that have sold shares to the public and you can look in the New York Times or the Wall Street Journal or online, on Yahoo Finance or Google or other sites and look at stock prices for Coke, for MacDonald’s and what those stock prices tell you is what the value of the company is. And how do you figure out the value of the company? Well you look at where the stock price is. You count how many shares are outstanding. The shares outstanding will

be listed in various filings with the FCC. You multiply the shares outstanding times the stock price. That tells you the price you’re paying for the equity of the company, so if you go back to our example of our little lemonade stand we have 1,500 shares of stock outstanding. We sold them for a dollar initially, one-third of them to an investor and the business initially had a value of $1,500. So what is the business worth today? Well one way to look at it; let’s look at other lemonade stand companies. Let’s assume other lemonade stand companies have

sold either in the private market, the public market for a price of 10 times earnings or 10 times profit, so that will give you a sense of value. You could look at the stock market if there are other examples of a business similar to a lemonade stand company. Perhaps a company that sold soda every month would be a good example, but let’s use a comparable example. So let’s assume another lemonade stand company is trading at 20 times earnings in the stock market. Well we earned a dollar per share in year five. If we put a

20 multiple on that dollar the business is worth, according to the comparable about $20 per share. We’ve got 1,500 shares outstanding. We multiply 1,500 times 20. Now our business is worth $30,000. So we had a company that started out at 1,500, five years later it’s worth $30,000. That’s actually quite good. Well how do we raise $4,000 if that’s the appropriate value for our business? Well if we sold 200 of our shares, 200 of our shares that are today now worth $20 a share we could raise the $4,000 that we are talking about. Now what would

that do? What would happen if we sold 200 of our shares in the market? Well our interest in the business would go down because today we own 66 and 2/3 percent or 2/3 of the company. A third is owned by our private investors. Well if we sold stock in the market, if we sold 200 of the shares that we would own our ownership would go from 67% to 53%, so the good news there is we’d still have control of the business because in most public companies owning a majority allows you to control the business going

forward, but because the company is now owned by public shareholders you have to make sure their interests are properly represented, so you have to have a board of directors, a group of individuals who represent the interests of the shareholders who have a duty to make sure that their shareholders are treated properly and you wouldn’t have the same degree of flexibility you had when you were a private company because you have other constituencies that you need to think about. Now the benefit of the IPO is the stock would now be liquid. There would be a market

where it would trade in the public markets and then over time if I wanted to sell more stock I could do so or if new investors wanted to come in they could buy stock and our stock would now be liquid. It would make me feel better about this business in terms of my ability to at some point exit or if a I wanted to raise more money I could sell stock fairly easily in the market because each day you could look up the price either on the web or in the New York Times or otherwise

and you could figure out what your business is worth. Okay, now how does this matter to you? Now the purpose of the example of our lemonade stand is just going to give you a primer on what companies are, what they do, how they earn profits, what the various reports they provide to investors so investors can figure out what they’re worth and the purpose of this lecture is to give you a sense of some of the things you need to think about when you’re thinking about investing perhaps some of your own money whether you want to

invest in a lemonade stand or you want to invest in a company on the market, so a few basic points to think about. One of the most important is if you’re going to be a successful investor it makes a lot of sense to start early. Now that’s kind of a hard thing. Today you’re probably a student. You don’t have a lot of spare money. Keys to Successful Investing Well let’s assume at 22 you have a pretty good job. Instead of spending your money on gadgets or a fancy apartment or not so fancy apartment or going

out and drinking a fair amount you put some money aside and you start investing money. Let’s say you could save $10,000 at 22 and you can earn a 10% return on that money between now and the time you retire. What would you have in 43 years? The answer, if you put aside $10,000, you don’t save another penny and you invested it in your and you earned 10% on your money each year you’d have $600,000 in year 43 and the reason for that is well in year 1 your $10,000 will become 11, in year 2 your

$11,000 would grow by 10% and so you would be earning interest not just on your original principle, but you’d earn interest on the interest you had earned the previous year and that compounding effect allows money to grow in an almost exponential fashion. Now obviously if you earn more than 10% you can earn even higher returns. Now that’s if you put $10,000 aside at 22 you’d have $600,000 in 43 years. That’s pretty good. What is you had to wait until you were 32 when you earn the same 10% per annum? The problem there is by year

33 you’d only have $232,000. Maybe that is not enough to retire, so the key thing here is if you’re going to be an investor one of the most valuable assets you have today as someone who is 18 or 19 years-old is your youth. You want to start early so that your money can grow over time. Now what if you could earn 15%? I'll give a you better sense of how powerful compounding is because remember at 10% for 43 years you’d have $600,000. That’s pretty good, but if you earned 15% you’d have over 4 million. Now

you’re in a pretty good position and so obviously making smart decisions about where you put your money has a huge difference in what you’re retirement assets are. Now obviously if could put aside more than $10,000, if you could put aside $10,000 each year then you’re wealth would be quite enormous. Now just for fun if you were one of the world’s great investors, Warren Buffet being a good example, if you could earn 20% per year for 43 years you’d have 25 million dollars. Again the original $10,000 investment would increase about 2,500 times over that period of

time just by earning a 20% return. Albert Einstein said the most powerful force in the universe is compound interest, so the key is start early, earn an attractive return and avoid losing money and you’re going to have a very nice retirement. Okay, now let’s talk about the risk of losing money. Now let’s assume that in order to try to get a 20% return you took a lot of risk and it turns out that every 12 years you lost half your money because you just made—you hit a bad patch in the market or you made dumb

decisions. Well your 25 million dollars at 20% would now only be worth a million eight in 43 years, so a key success factor here is not just shooting for the fences, trying to get the highest return. It’s avoiding significant loses over the period. Okay, so as Warren Buffet says rule number one in investing is never lose money and rule number two is never forget rule number one, so if you can avoid loses and earn an attractive return over time you’re going to have a lot of money if you can stick at it for a long

period of time. So how do you be a successful investor? Now I'm assuming that you’re not going to go into the business of investing. I'm assuming that you’re going to be a doctor or a lawyer. You’re going to pursue your passion, but you’re going to have some money that you’re going to save over time and I'm going to give you my advice on the topic. It’s not necessarily definitive advice, but it’s the advice I would give my sister, my grandmother on what she should do if she were in the same position. I think that’s probably

the right way to think about it. So number one, how do you avoid losing money? What are the good places to invest? My first piece of advice is despite the story about the lemonade stand I’d avoid investing in lemonade stands. I’d avoid investing in startup businesses where the prospects are not very well known because again you don’t need to make 100% a year to have a fortune. You just need to invest at an attractive return 10, 15 percent over a long period of time. Your money grows very significantly. So how do you avoid the riskiest

investments? My advice would be to invest in public securities, invest in listed companies, companies that trade on the stock market. Why, because those businesses tend to be more established. They have to meet certain hurdles before they go public. The stocks are liquid, so you can change your mind if you want to sell. If you invest in a private lemonade stand it’s hard to find someone to take you out of that investment unless that business becomes fabulously profitable. So that’s piece of advice number one, invest in public companies. Number two, you want to invest in businesses

that you can understand. What I mean by that is there are lots of businesses that you come in that you deal with in the course of your day in your personal life, whether it’s a retail store that you know because you like shopping there or it’s a product, your iPad that you think is a great product, but you have to understand how the company makes money. If the business is just too complicated, you don’t understand how they make money, even if they’ve had a great track record I would avoid it and a lot of people

thought Enron was an incredible business because it appeared to have a good track record, but very few people understood how they made money. It was good to avoid it. Another very important criterion is you want to invest at a reasonable price. It could be a fabulous business that is done very well over a long period of time, but if you pay too much for it you’re not going to earn a very good return investing in that company. The last bit is that you want to invest in a business that you could theoretically own forever. If

the stock market were to close for 10 years you wouldn’t be unhappy. What do I mean by that? Again if you’re going to compound your money at a 10 or 15 percent return over a 43 year period of time you really want a business that you can own forever. You don’t want to constantly have to be shifting from one business to the next. And what are businesses that you can own forever? Well there are very few that sort of meet that standard. Maybe a good example is Coca Cola. What is good about Coca Cola? It’s

a relatively easy business to understand. You understand how Coke makes money. They sell a formula or syrup to bottlers and to retail establishments and they make a profit every time they serve a Coca Cola. People drank a lot of Coca Cola for a very long period of time. The world’s population is growing. They sell it in almost every country in the world and each year people drink a little bit more Coca Cola, so it’s a pretty easy business to understand and it’s also a business that I think is unlikely to be competed away as a

result of technology or some other new product. It’s been around long enough. People have grown used to the taste. Parents give it to their children and you can expect it will be around a long period of time. I think that’s one good example. Another good example might be MacDonald’s. You may not love MacDonald’s hamburgers. You may or you may not, but it’s a business that it has been around for 50 years. You understand how they make money. They open up these little—build these little boxes. They rent them to the franchisees. They charge them royalties in

exchange for the name and they sell hamburgers and French fries and you know what? People have to eat. It’s relatively low cost food. The quality is pretty good and they continue to grow every year. So I think the consistent message here is try to find a business that you can understand that’s not particularly complicated that has a successful long term track record that makes an attractive profit and can grow over time. So what are the key things to look for in a business as I say that lasts forever? Well you want a business that sells

a product or a service that people need and that is somewhat unique and they have a loyalty to this particular brand or product and that people are willing to pay a premium for that. Another good example might be a candy business. While people are going to buy generic versions of many kind of food products, flour, sugar, they don’t need to have the branded product. When it comes to candy people don’t tend to like the Walmart version or the Kmart version. They want the Hershey chocolate bar or the Cadbury chocolate bar or the See’s Candy. They

want the brand and they’re willing to pay a premium for that and so that’s I think a key thing. You want the product to be unique. You don’t want it to be a commodity that everyone else can sell because when you sell a commodity anyone can sell it and they can sell it at a better price and it’s very hard to make a profit doing that. If you’re investing for the long term you want to invest in businesses that have very little debt. In our little example before we talked about our lemonade stand. There is

$250 worth of debt. That didn’t put too much pressure on the lemonade stand company, but if it had been $1,000 and we hit a rough patch the business could have gone out of business for failure to pay its debts. The shareholders could have been wiped out. So if you can find a company that can earn attractive profits, that doesn’t have a lot of debt or they generate vastly more profits than they need to pay the interest on their debt that is a safe place to put your money over a long period of time. You want

businesses that have what people call barriers to entry. You want a business where it’s hard for someone tomorrow to set up a new company to compete with you and put you out of business. I mean going back to the Coca Cola example. Coca Cola has such a strong market presence. People have come to expect when they go to a restaurant they can ask for a Coke and get a Coke. It’s very hard for someone else to break in. Of course there is Pepsi and there are other soda brands, but Pepsi has been around a long

time and Coca Cola and Pepsi have continued to exist side by side over long periods of time. It’s going to be very hard for someone to come in and come up with a new soft drink that is just going to put Coca Cola out of business, so when you’re thinking about choosing a company make sure that they sell a product or a service that is hard for someone else to make a better one that you’ll switch to tomorrow. Look for something where people have real loyalty and they won’t switch and it doesn’t—even if someone offers

the same, similar product for 20% less they still want the branded, high quality product. You also want businesses that are not particularly sensitive to outside factors, so-called extrinsic factors that you can’t control. So if a business will be affected dramatically if the price of a particular commodity goes up or if interest rates move up and down or if currency prices change. You want a company that is fairly immune to what is going on in the world and I'll use my Coca Cola example. I mean if you think about Coca Cola it’s a product that has

been around probably 120 years. Over that period of time there have been multiple world wars. There has been all kinds of you know, development of nuclear weapons, all kinds of unfortunate events and tragedies and so on and so forth, but each year the company pretty much makes a little bit more money than they made before and they’re going to be around and you can be confident based on the history that this is a business that is going to be around almost regardless of whether interest rates are at 14%, whether the US dollar is not worth

very much or the price of gold is up or down. Those are the kind of companies you want to invest in, in the long term, businesses that are extremely immune to the events that are going on in the world. Another criteria, if you think back to our lemonade stand company, as we grew we had to buy more and more lemonade stands. Now those lemonade stands only cost $300 each, but imagine a business where every time you grew you had to build a new factory to produce more and more product and those factories were really expensive.

Well that company might generate a lot of cash from the business, but in order to grow you’re going to have to just reinvest more and more cash into the business. The best businesses are the ones where they don’t require a lot of capital to be reinvested in the company. They generate lots of cash that you can use to pay dividends to your shareholders or you can invest in new high-return, attractive projects. So the key here is low capital intensity, so let’s talk about a low capital intensity business. Maybe the best way to think about a

low capital intensity business is to think about a high capital intensity business. If you think about the auto industry before you produce your first car you have to build a huge factory. You’ve got buy a lot of machine tools. You have to make an enormous investment before you can send your first car out the door and those machine tools wear out over time and as you make more and more cars you have to invest more and more in the factories, so it’s a business that historically has not been very attractive for the owners of the

business. If you looked at the price of General Motors’ stock 50 years ago it actually hasn’t changed meaningfully even up until the last several years before it went bankrupt. If you ignored the most recent period up through the bankruptcy of GM very few people made money investing in GM over a 40 or 50 year period of time and the reason for that is that GM constantly had to reinvest every dollar that they generated to build better and better factories so they can be competitive. If you compare that to Coca Cola while Coca Cola there are

bottling companies around the world a lot of those bottling companies aren’t even owned by Coca Cola. What they’re really doing is they’re selling a formula and in exchange for that formula they get a royalty on every dollar that is spent on Coca Cola. Those are the better businesses. Another good example might be American Express. If you think about the American Express card when you take your American Express card and you buy something American Express card gets a few percent of every dollar that you spend. So you put up the capital and they get a several

percentage point return on that. They get 3% of so of what you spent. So businesses where you own a royalty on other people’s capital are the best businesses in the world to invest in. I guess the last point I would make is that if you’re going to invest in public companies it’s probably safest to invest in businesses that are not controlled. A controlled company is kind of like our lemonade stand business that we took public. The problem with a controlled company unless the controlling shareholder is someone you completely trust, unless there is someone that has

a great track record for taking care of so-called minority investors, the non-controlling shareholders it can be a risk of proposition to invest in that business because you’re at the whim of the controlling shareholder and even if the controlling shareholder today is someone that you feel comfortable with there is no assurance that in the future they might sell control to someone else who is not going to be as supportive of the shareholders of the business. So it’s not that you just—you can simply have a profitable business and a business that has done well. You have to

make sure that the management and the people that control the business think about you as an owner and are going to protect your interests. So these are some of the key criteria to think about. The Psychology of Investing and Mutual Funds Now when are you ready to start investing money? My guess is you’re a student. You probably have student loans. Perhaps you even have some credit card debt. You’re going to graduate. You’re going to get a job. So you don’t want to jump right in and while you have a lot of debt outstanding start investing

in the stock market. The stock market is a place to invest when you’ve got a good—you have money you can put away that you won’t need for 5 years, maybe 10 years. So if you’re paying relatively high interest rates on your credit cards you definitely want to pay off your credit cards first before you think about investing in the stock market. You student loans are probably lower cost than your credit cards, but again here my best advice would be if your student loans are costing you six or seven percent well if you pay them off

it’s as if you earned a guaranteed six or seven percent return and you’re just better off getting rid of your credit card debt and even your student loan debt before you commit a lot of material amount of money to the stock market. So what do you do with your money while you’re waiting to invest? The answer is you pay down your debt and you want to have—even once you’ve paid off your credit card debts, perhaps you paid down your student loans, you want to have enough money in the bank so that even if you were

to lose your job tomorrow you’ve got a good 6 months, maybe even 12 months of money set aside. So these are some pretty high standards and obviously therefore these make it harder to start investing earlier, but the safest course of action in order to be a successful investor is be as—have as little debt as possible. Be comfortable having some money in the bank, so if you lose your job tomorrow you can live until to find your next opportunity and once you’ve achieved those goals then put aside money that you don’t need to touch. If you

can do that then you can be a successful investor. So let’s talk a little bit about the psychology of investing, so we’ve talked about some of the technical factors, how to think about what a business is worth. You want to buy a business at a reasonable price. You want to buy a business that is going to exist forever, that has barriers to entry, where it’s going to be difficult for people to compete with you, but all those things are important, but even—and a lot of investors follow those principles. The problem is that when they put

them into practice and there is a panic in the world and the stock market is heading down every day and they’re watching the value of their IRA or their investment account decline the natural tendency is sort of to do the opposite of what makes sense. Generally it makes sense to be a buyer when everyone else is selling and probably be a seller when everyone else is buying, but just human tendencies, the tendency of the natural lemming-like tendency when everyone else is selling you want to be doing the same thing encourages you as an investor to

make mistakes, so a lot of people sold into the crash of ’87 when in fact they should have been a buyer in that kind of environment. So that’s why I talked before a little bit about why it’s very important to be comfortable. You want to be financially comfortable. If you have student loans you want to have a manageable amount of debt. You probably don’t want to be paying any—you don’t want to have any revolving credit card debt outstanding. You want to have some money in the bank because if you’re comfortable then the money that you’re

risking in the stock market is not going to affect your lifestyle in the short term. As long as you don’t need that money tomorrow you can afford to deal with the fluctuations of the stock market and the fluctuations, depending on who you are can have a big impact on you. People tend to feel rich when the stocks are going up. They tend to feel poor when the stocks are going down and the reality is the stock market in the short term is what Ben Graham or even Warren Buffet called a voting machine. Really stock prices

reflect what people think in the very short term. If affects the supply and demand for investors, buying and selling stocks in the short term. Over the long term however, stocks tend to reflect the value of the businesses they own. So if you’re buying businesses at attractive prices and you’re owning them over long periods of time and those businesses are growing in value you’re going to make money over a long period of time as long as you’re not forced to sell at any one period of time. To be a successful investor you have to be able

to avoid some natural human tendencies to follow the herd. When the stock market is going down every day you’re natural tendency is to want to sell. When the stock market is actually going up every day your natural tendency is to want to buy, so in bubbles you probably should be a seller. In busts you should probably be a buyer and you have to have that kind of a discipline. You have to have a stomach to withstand the volatility of the stock markets. The key way to have a stomach to withstand the volatility of the stock

market is to be secure yourself. You’ve got to feel comfortable that you’ve got enough money in the bank that you don’t need what you have invested unless—for many years. That’s a key factor. Number two, you have to recognize that the stock market in the short term is what we call a voting machine. It really represents the whims of people in the short term. Stock prices are affected by many things, by events going on in the world that really have nothing to do with the value of certain companies that you’re investing in, so you’ve got to

just accept the fact that what you own can go down meaningfully in value after you buy it. That doesn’t necessarily mean you’ve made an investment mistake. It’s just the nature of the volatility of the stock market. How do you get comfortable? Well the way you get comfortable with the volatility is you do a lot of the work yourself. You don’t just buy a stock because you like the name of the company. You do your own research. You get a good understanding of the business. You make sure it’s a business that you understand. You make sure

the price you’re paying is reasonable relative to the earnings of the company and we talked before a little bit about earnings and how to look at a value of a business by putting a multiple on earnings. A more sophisticated way to think about a business is to—the value of anything is actually the amount of cash you can take out of it over a very long period of time and people do build models to predict how much cash a business will generate over a long period. That is probably something a little bit more complicated than we’re

going to get into for the purpose of this lecture, but maybe another way to think about it would be helpful. So when you by a bond and you get an interest rate, so today the 10 year Treasury pays about 3%. You’re earning 3% on your investment. When you buy a stock that’s trading at a multiple of its profits or a so-called PE ratio or a price to earnings ratio let’s say of 10 times it’s very similar to a bond. In fact, if you flip over the PE ratio, you put the E on top, what the

business is earning and you put the price that you’re paying for the stock on the bottom it’s what the earnings are per share over the price you get what’s called an earnings yield and you can compare that earnings yield to for example the 10 year Treasury, so a company trading at a 10 PE is actually trading at a 10% earning yield, so you can actually think about stocks or buying equity in a business as very similar to buying an interest in a bond. The difference is in the bond you know what the coupon is going

to be. You know that 3% interest rate every year for the next 10 years. With stock you don’t know what the coupon is going to be. The coupon in the stock is how much profit it earns and you can try to project that profit based on the history of the business and what the prospects are, but that profit is going to move up and down every year. Now hopefully the long term trend is up and so the way I think about the decision between buying a bond or buying a stock is I want to make

sure that the earnings yield, that earnings per share over the price I'm paying for the stock is higher than what I could get owning a Treasury and that earnings yield is something that’s going to grow over a long period of time. Now if you had a business that was growing at a very, very high rate very often—or growing its profits at a very high rate, very often people are prepared to pay a pretty high multiple of those profits. Why, because they expect that earnings yield to grow, so if you had a business you might even

pay—it might be cheap some day to buy a business at 30 times its profits or a 3% or a 3.3% earnings yield if you think that 3.3% is going to grow at a high rate and eventually get meaningfully higher to a 5, a 6, a 7, a 8 or 10 percent rate. Those kinds of investments are much riskier. The higher the multiple generally the higher the risk you take because you’re betting more on the future of the business. You’re betting more on the future profitability. So my basic piece of advice in recommending the MacDonald’s and

the Coca Cola’s of the world are to find businesses that where you’re going in yield your earnings yield is high enough that you don’t need to be right about a very high rate of growth into the future in order to earn attractive rate of return. Okay, so the few key success factors for being an investor in the stock market are one, do the homework yourself. Make sure you understand the companies that you’re investing in. Two, invest money that you won’t need for many years and three, limit the amount of—don’t borrow money certainly to invest in

the stock market and limit that amount of leverage, if any, that you have as an investor. Okay, so after this brief 40 minute lecture I wouldn’t just jump in immediately and start investing in the stock market. You have some work to do. There is some books you can read and we’re going to provide you with a list of recommended books at the end of the lecture that will help you learn more about investing. Almost everything you need to know about investing you can actually read in a book. I learned the business from reading books as

opposed to reading books and the experience associated with starting small and investing in the stock market. Let’s say this is just not for you. I don’t want to invest, buy individual stocks. It just seems too risky. I don’t have the time to do my own research. What are your alternatives? Well you alternatives are to outsource your investing to others. You can hire a money manager or you can hire a group of money managers and there are a couple of different alternatives for a startup investor. The most common alternative is mutual fund companies. So what is

a mutual fund? A mutual fund is I guess technically it’s a corporation, but where you buy stock in this corporation and the manager selects a portfolio of stocks. So what they do is they pool together capital, money from a large group of investors. So say they raise a billion dollars and they take that money and they invest in a diversified collection of securities. Now the benefit of this approach is that with a tiny amount of money, even less than $1,000 you can buy into a diversified portfolio managed by a professional manager who is compensated to

do a good job for you investing in the market. So mutual funds are a good potential area for investment. The problem is there are probably 7, 8,000, maybe 10,000 different mutual funds and some are fantastic and some are not particularly good, so you need to do research to find a good mutual fund manager in the same way that you need to find individual stocks, so it’s not just the easy thing of just invest in mutual funds. So here are a few key success factors in identifying a mutual fund or a money manager of any kind

to select. Number one, you want someone who has an investment strategy that makes sense to you; you understand what they do and how they do it. They’re not appealing to your insecurity by using complicated words and expressions that you don’t understand. If they can’t explain to you in two minutes what they do and how they do it and why it makes sense then it’s a strategy you shouldn’t invest in. Number two and this is not necessarily in this order. This probably should be number one, is you want someone with a reputation for integrity. Again if

you’re starting out you probably want to invest in some of—a mutual fund that is sponsored by some of the larger mutual fund complexes as opposed to a tiny little mutual fund that is privately—by a mutual fund company that you’ve never heard of. There is some benefit in the larger institutions that have—you can be more confident that they’re not going to steal your money. You want someone, an approach where the investor invests money on the basis of value. Now this sounds kind of obvious, but value investing has a very long term track record and there are

other kinds of investing including technical investing where people are betting on stocks based on price movements, but I highly recommend against those kind of approaches. So you want someone making investments where they’re buying companies based on their belief that the prospects of the business will be good and that the price paid relative to what the business is worth represents a significant discount. You want to invest with someone that a long term track record and I would say 5 years is the absolute minimum and ideally you want someone who has 10, 15, 20 years of experience

investing in the markets because there is a lot that you can learn being a long term investor in the market. You want someone who has a consistent approach, where they haven’t changed what they do materially year by year, that they have a stated strategy that they’ve kept to thick and thin that has enabled them to earn an attractive return over their lifetime as an investor and I always say in some way most importantly you want someone who is investing the substantial majority of their own money alongside yours. Obviously it shouldn’t be that they’re investing your

money. This is what they do for you, but for their money they do something meaningfully different. You want someone whose interests are aligned with yours. If it’s a mutual fund you want them to have a lot of money in their own mutual fund. If it’s a hedge fund, which is a privately sold fund for investors who have higher net worth you want a manager who is investing alongside you as well. I have a strong aversion to strategies that require the use of leverage, so in the same way you want to invest in companies that use

very little debt you want to invest in investment strategies that you very little leverage. If you can avoid leverage and invest in high quality businesses or invest with high quality managers it’s hard to lose a lot of money versus the use of leverage. Lots of money can be lost. Now in the same way when you’re building a portfolio of stocks where you don’t want to put all of your eggs in one basket and you want a reasonable degree of diversification and the more sophisticated, the more work you do, the higher the quality the business is

you invest in the more concentrated your portfolio can be, but I would say for an individual investor you want to own at least 10 and probably 15 and as many as 20 different securities. Many people would consider that to be a relatively highly concentrated portfolio. In our view you want to own the best 10 or 15 businesses you can find and if you invest in low leverage, high quality companies that’s a comfortable degree of diversification. If you invest with money managers you probably don’t want to put all your eggs in one basket there either and

here you probably want to have two or three different, perhaps four different alternative, mutual funds or money managers, so again there you have some degree of diversification in your holdings. Finance in Our Lives So we spent the hour. We started with a little lemonade stand company and the purpose of that was to give you some of the basics on how to think about a business, where the profits comes from, what revenues are, what expenses are, what a balance sheet is, what an income statement is, how to think about what a business is worth, how to

think about what the difference between what a good business is versus a bad business, how debt offered is generally higher, actually lower risk, but lower return, how equity investors or investors who buy the stock or the ownership of a business have the potential to earn more or lose more and we use that background as a way to think about- We use that as the—just as the basics to get someone of the vocabulary to think about investing and we talked about investing in the stock market. We talked about ways to think about how to select investments,

how to deal with some of the psychological issues of investing. We covered a fair amount of ground in a relatively short period of time. Now I entitled the lecture Everything you Need to Know about Finance and Investing in Less Than an Hour. Well it really isn’t everything you need to know. It’s really just an introduction and hopefully I didn’t mislead you, induce you to watch this for an hour, but there is a lot more that can be learned and there is wonderful books that can teach you on the topic, so I think what is interesting

about investing whether you choose this as a fulltime career or not if you’re going to be successful in your career you’re going to make some money and how you invest that money is going to make a big difference in the quality of life that you have and perhaps that your children have or the kind of house you’re able to buy or the retirement that you’re going to be able to enjoy and we talked about the difference between a 10% return and a 15 and a 20% return over a very long lifetime and what impact that

has in terms of how much wealth you create over the period, so investing is going to be important to you whether you like it or not and learning more about investing is going to have a big impact on your quality of life if money is something that you need in order to meet some of your goals. So I recommend this as an area worthy of exploration and the more you learn about investing the more—these same concepts while they’re useful in deciding how to invest your portfolio they’re also useful to you in thinking about decisions like

buying a home, making decisions in your line of work, if you’re a lawyer whether to hire additional people, these kinds of calculations and thought processes are helpful and they’re helpful in life and I recommend that you learn more. So take a look at the reading list and good luck.

Related Videos

1:01:30

Valuation in Four Lessons | Aswath Damodar...

Talks at Google

1,628,443 views

39:03

How Millionaire Bankers Actually Work | Au...

Insider

2,732,694 views

58:20

Think Fast, Talk Smart: Communication Tech...

Stanford Graduate School of Business

39,922,818 views

15:23

Mark Cuban Answers Business Questions From...

WIRED

1,858,849 views

22:32

When JPMorgan CEO Jamie Dimon Speaks, the ...

Bloomberg Originals

2,196,855 views

1:08:12

Bill Ackman: Pershing Square, hedge funds ...

Saïd Business School, University of Oxford

580,785 views

42:14

Michio Kaku: The Universe in a Nutshell (F...

Big Think

21,316,396 views

19:01

Top 10 Financial Concepts You Must Know | ...

CA Rachana Phadke Ranade

739,473 views

23:50

An Activist Investor on Challenging the St...

TED

86,199 views

19:31

The Rise and Fall of Old Monk | Business C...

Think School

566,773 views

31:00

How The Economic Machine Works by Ray Dalio

Principles by Ray Dalio

39,998,092 views

19:03

"The Making of an Investment Banker," With...

University of Virginia School of Law

654,494 views

15:50

Is this the end of Adani? Decoding SEBI's ...

Think School

704,143 views

1:17:10

Warren Buffett, Chairman, Berkshire Hathaw...

Terry College of Business at the University of Georgia

2,114,213 views

17:34

Explained | The Stock Market | FULL EPISOD...

Netflix

14,447,335 views

1:06:02

The Story Of Hotmail, Rich Lifestyle, Micr...

Raj Shamani

706,742 views

13:46

The Most Interesting Investor Who Ever Lived

Hamish Hodder

288,509 views

5:20

Warren Buffett breaks down how he would in...

CNBC Television

1,056,047 views

43:43

Principles for Dealing with the Changing W...

Principles by Ray Dalio

53,413,417 views

28:07

Blinkit’s Genius Strategy that stunned Ama...

Think School

1,591,605 views