Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

94.97k views2203 WordsCopy TextShare

Smart Risk

Easily Predict the Next Candle Using Simplified ICT Candle Range Theory!

Today in this video, we wi...

Video Transcript:

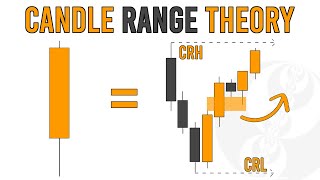

hey Traders and welcome to another episode of smart risk today we will talk about the candle range Theory an advanced concept that's been kept secret from the ICT trading Community but has the potential to Skyrocket your win rates by mastering this concept you will be able to predict upcoming price movements and candle formations before they even happen in the market this powerful trading model will give you insights into being on the same side as institutional money instead of being on the opposite side of their trades so make sure not to miss any part of this video and watch carefully we're going Beyond just Theory today we'll walk you through the candle range Theory step by step breaking down the key points and Concepts you need to fully Master this Advanced trading model we always appreciate your support so please give this video a thumbs up and subscribe to our Channel if you are new see you after intro [Music] [Music] welcome back Traders so let's get started before we jump into the basics of Candlestick CRTs let's take a moment to understand the psychology behind candle range Theory so what exactly is candle range Theory the idea is simple every candle you see on a chart represents a range in other words a candle you see on a higher time frame is just a range of price action when you zoom in to a lower time frame since ranges can be swept WT broken out or retested in the market all of these actions can also show up in Candlestick patterns every candle has a high and a low right so if you zoom in you'll see that a range forms between the candle's highest and lowest points on a lower time frame you've probably noticed that the market moves through three main phases accumulation manipulation and distribution price is always cycling through these phases imagine it like a never-ending Loop for first the price accumulates then it gets manipulated and finally it's distributed before the whole process starts over again this pattern is what we call the power of three and it's basically the heartbeat of the market basically the price goes through an accumulation phase which is essentially a period of consolidation where the price moves sideways then it manipulates by taking out liquidity and finally it distributes within the range that the manipulation created this is where you should start looking for the typical AMD the Asian session the London session and the New York session if the Asian session has accumulated you typically expect the London session to manipulate and then the New York session to distribute but here's a pro tip to keep in mind if the price has expanded instead of accumulating during the Asian session don't expect the London session to manipulate instead you should expect it to accumulate which means you then look for the New York session to manipulate so it all comes down to what the Asian session did just check out the Asian session first and that will give you the most accurate way to identify AMD and the power of the three phases regarding time frames the 15-minute chart is your best bet for recognizing AMD it gives you clear price action that also aligns with higher time frames so with that in mind let's dive into how you can identify a CRT pattern using Candlestick patterns afterward we'll look at different scenarios that might come up when you're trying to identify CRTs on your chart in the bullish scenario the Candlestick based CRT typically refers to a three candle sequence on a higher time frame like 1 hour or upper here's how it works the first candle sets up a range with its high and low the second candle takes out the liquidity of the first candle by a wick the third candle breaks out of this range keep in mind though that the CRT model doesn't always have to be a three candle sequence it can also form with a series of more than three candles the key difference is that a three candle sequence typically happens over a shorter period but the principle Remains the Same whether it's three candles or more for example in this candle series you can see that multiple candles were formed to reach the highest point of the range candle the sequence goes like this first a range candle was formed followed by an inside bar then we had a sweeping candle that swept below the range with its shadow and finally the price formed several more candles until it hit the high of the range candle these Concepts also apply to bearish markets you can apply these principles across different time frames and on any price action based chart to solidify what we have learned so far let's see more examples of Candlestick based CRT models that we might encounter in the market starting from the top this first scenario is the most critical CRT model offering a high probability of success why because it perfectly captures the accumulation manipulation and distribution phases all within a three candle sequence what we call the power of three in just three candles let's say we have a perfect cell-side liquidity pool right beneath this bullish candle what happens next is that the price pushes upward entering the accumulation phase the price then manipulates by taking out the high of the range and finally it enters the distribution phase signaling that the price will likely continue downwards toward the sells side liquidity this gives us a clear continuation to the downside here we've already seen the accumulation manipulation and distribution the complete power of three next we see a range candle followed by a bullish green candle that sweeps below the range then the price forms multiple candles until it closes above the range once again a range is formed liquidity gets taken out and then the price pushes higher eventually reaching the range as high it's the same scenario here a range candle forms but it takes a bit longer for the price to sweep the range candle low then almost immediately the price reverses Direction heads towards the range as high and closes above it the rest follow the same pattern as the examples we've just discussed now let's see what criteria and rules we need to consider in order to identify high probability CRTs CRT is basically an objective and mechanical way to simplify your trading by suggesting simple steps fixed objectives and rules and also by minimizing the terms and condition that you need to look for to execute a high probability trade first you need to look for CRTs around key levels so the higher time frame candle should be identified around the key areas second timing is crucial make sure you're identifying CRTs at Key times for high probability CRTs here are the key times to consider in the Forex Market 1:00 a. m. 5:00 a.

m. 9:00 a. m.

1 p. m. 300 p.

m. 6 and 900 p. m.

for matching your entry time frame with the crt's time frame you should consider that if your identified CRT range is on the monthly time frame then for entry you should use the daily time frame if your CRT comes from the daily chart you should execute your trade in the 1hour time frame if your identified CRT is on the 4-Hour time frame then entries must come from the 15-minute time frame if your CRT is on the 1 hour time frame then you can use a 5 minute or 1 minute time frame for your entry if you use the 15-minute time frame to identify CRTs then you should use one minute to place a sell or buy position now let's see how to use the CRT model to our advantage and execute trades based on it here we have the NASDAQ 1hour time frame on the screen as you can see the price has created a large bearish candle at 2: p. m. a key time so I'm going to highlight its high and low as the potential CRT range candle high and low next I'll zoom into the 15-minute time frame and wait for the 300 p.

m candle to form now as you can see the 3pm candle has formed and I'll highlight its high and low as the latest candle range high and low if you look closely you can see that the three PM candle sweeps below the range of the hourly 2PM candle with its Wick and then immediately pushes back inside the 2PM candles range following this we see the price push upwards and eventually close above the 3pm candle high if we zoom out to the 1hour time frame we can see that the price has swept the 2PM candles low with this 3pm dogee candle confirming a CRT model formed at a key time there's a high probability that after completing the manipulation phase by sweeping sell-side liquidity below the 2PM candles range the price will push higher toward the buy side liquidity above the 1H hour 2PM candle this provides a great opportunity to go long in the market next I'll zoom into the 5minute time frame to find an entry opportunity for a long position as you can see there's an order block on the 5 minute time frame which is the last selling candle before the price started a bullish move that broke out above the 15-minute candle's high and closed above it I'm going to place my buy limit order at the the highest point of this order block and wait for the price to activate it for the takeprofit you can either set it at the midpoint of the 1H hour time frames range which provides a 2:1 reward to risk ratio or at the highest point of the range which gives an R to ratio of 4. 9 now let's see what happens next as you can see the price has activated our by limit order and we are officially in the market the first takeprofit is hit as the price reaches the midpoint of the range eventually the price hits the second profit Target at the highest point of the 1hour time frame's 2PM candle range and the trade plays out successfully now let's move on to the next example here we have the euro dollar 1hour time frame on the screen as you can see we have a perfect CRT model based on this 1H hour 9 a. m.

candle we have all three steps of the power of three accumulation manipulation and distribution after forming this large candle as crt's range candle we can see that the price swept the liquidity accumulated below the first candle with a wick then closed inside the range and after price immediately pushed to the high of the candle range let's see if we were behind the screen and monitoring the market how could we enter the market with this CRT model after identifying our range candle and drawing the high and the low of the range candle as the CR and crl we need to zoom into the 15minute time frame to gain a clearer view of price action and also to monitor the Candlestick better in the next step we should wait for the 9:00 a. m. and monitor the price action in this spefic specific time as you can see price pushed lower and has taken below of the range candle with 900 a.

m.

Related Videos

19:26

NEVER install these programs on your PC......

JayzTwoCents

3,394,903 views

16:27

ICT's Optimal Trade Entry (OTE) Explained

Smart Risk

52,663 views

14:55

Transform Your Trading with This Proven Or...

Smart Risk

112,646 views

18:00

This FENCE Lasts 100 years!!!!

SuburbanBiology

1,763,171 views

17:04

The Hidden Engineering of Landfills

Practical Engineering

3,098,667 views

32:34

The MATH OF WINNING in trading

The Art of Trading

242,051 views

15:34

Candle Range Theory (CRT) - All Secrets Re...

EmzCapitals

18,399 views

30:51

"Why You Can't Afford Anything!" - How The...

Tom Bilyeu

288,462 views

16:44

Order Block Simplified - Smart Money Course

Smart Risk

792,496 views

51:03

What Voyager Detected at the Edge of the S...

Astrum

1,315,146 views

14:04

Equal High & Low Liquidity (will change yo...

JeaFx

24,562 views

21:58

How I Nailed Trading with the MACD Indicat...

Ross Cameron - Warrior Trading

343,507 views

23:47

Trading Candlesticks Was Hard Until I Lear...

Abdullah Rasheed

164,768 views

55:11

Master This ONE Candlestick Pattern TODAY ...

Ross Cameron - Warrior Trading

734,530 views

18:39

Candle Range Theory Explained

Solomon King

29,495 views

11:38

This Trading Tip Will Make You $$$ (Induce...

JeaFx

84,835 views

15:51

I Built The First LAMINAR FLOW ROCKET ENGINE

Integza

1,462,970 views

13:53

I Found The Hidden Trading Pattern That Co...

TRADE ATS

164,673 views

26:26

My List of Top ICT Concepts for Successful...

Smart Risk

212,143 views

16:54

I Make $45k Per Month Trading One Simple S...

Garland Trader

71,177 views