Paying A Credit Card Bill (I Wish I Knew THIS)

889.24k views3703 WordsCopy TextShare

Daniel Braun

In this video we’re talking about your credit card bill to answer some important questions like "whe...

Video Transcript:

so when I got started with credit cards I remember getting my first credit card bill and having absolutely no idea what any of it meant I just knew that I was supposed to eventually pay back whatever I use that card for but I did not know when I was supposed to pay that back how much to pay back should I leave a small balance how to avoid interest and I remember just generally feeling confused by all the terms on my credit card statement so in this video I want to give you a complete guide to your credit card bill and explain exactly what's going on with 12 important terms you need to know and I'm also going to address some common concerns about paying your credit card that seem to trip people up all the time now I want to keep things moving with this video and make it as easy as possible to understand so let's get right into it with the first two terms which are going to be the statement opening date and the statement closing date so like the name says these dates are going to be found on your credit card statement that gets generated every month and you can find them by logging into your account with any issuware and they should be listed somewhere on that account but you can also find them by opening up a recent credit card statement also by the way I highly recommend you watch this video all the way through to get an idea of what we're talking about here but then go download and even print out one of your own credit card statements and grab a pen or a highlighter if you want to and then re-watch this video because your statement might look a little bit different than mine but I want you to follow along to learn all these terms and here I have an example of one of my statements from Chase for my freedom Flex card now we can see that it says my statement opening date is November 29th and my statement closing date is December 28th and the time it takes between the statement opening date and the statement closing date is also known as the billing cycle which typically lasts anywhere from maybe 28 to 31 days but that can vary from month to month it's storing these billing Cycles where your issuer will basically track all the transactions you make on your credit card so they'll keep a log of all the things you buy all the things you return and even all the payments you make to pay down your credit card balance which we'll talk about next year now on the statement closing date so on December 28th in my example the issuer is going to calculate the total of all these transactions from this one credit card account and they're gonna add it all up to give you what's called a statement balance that means any transactions made on the following day or later after that statement closing date so hear from me that will be on decem number 29th or later those are going to go on the next billing cycle now the statement balance that gets posted on that statement closing date might be slightly different from what's called your current balance and that's because your current balance is essentially whatever your balance is at any live Moment In Time whereas your statement balance that can be thought of as more of like a snapshot of your activity during a period of time that was your billing cycle so just to walk through an example with my credit card my statement balance here on this Chase Freedom Flex statement is listed and in this case they worded it as the New Balance so just watch out for similar terms but my statement balance here says 48. 73 because that's my net total of all the transactions during this billing cycle Snapshot from November 29th through December 28th now if maybe on December 31st so a couple of days after that billing cycle ended if I did nothing else but then bought something like maybe a cheap 10 bottle of champagne to celebrate the New Year in a very frugal way then my current balance will go up by 10 bucks to 58. 73 because that's what my live number is for the amount that I owe but that doesn't change my statement balance from that credit card bill because I'm in a new billing cycle when I bought that bottle campaign on December 31st so that 10 purchase is going to go towards my next billing cycle hopefully that all makes sense and again follow along with your own credit card statement if you want to but back to that 48.

73 statement balance we're looking at here so they basically took my previous statement balance of 30. 53 plus any purchases I made on this card which ended up being 318. 73 and then subtracted any payments or credits that I had back to my account which was 300.

53 now just to fully explain those numbers that 30 and 53 cents was my statement balance from the previous billing cycle which ended on November 28th so that was a day before this current billing cycle began and then the 318 73 in purchases on this credit card bill can be found from two things I bought through PayPal so you can see they list those things out at the bottom of my statement then the 300. 53 in payments came from two times that I paid down my balance during this billing cycle so the first time I made a payment on this card was on December 16th for 30. 53 and again that was my statement balance from the previous billing cycle that was listed at the top here and I'll talk more about why we always need to be paying the full statement balance every month later on in this video the other payment of 270 dollars that I made was more of a way to keep my credit utilization lower and I'm going to cover credit utilization a little bit later on as well because keeping that utilization percentage low is one of the quickest ways for certain people to see almost an immediate impact and boost to their credit score so it's important to understand now like I said I paid my full 30.

53 statement balance from the previous billing cycle and then later on before the next payment due date which I'll talk about next year I'm going to pay my full 48. 73 statement balance from this current billing cycle and the reason I do that is so that I can avoid paying interest entirely while still collecting cashback or points for my purchases it's really a common myth that you need to carry some sort of a balance and then pay interest on that to somehow show the credit bureaus that you're responsible with credit but that's completely 100 false so let me explain why with the next few terms here okay so in order to avoid paying any interest you're gonna have to pay the entire statement balance amount in full by What's called the payment due date now this payment due date is going to be at least 21 days days after the statement closing date and it's also going to fall on the same day every month so even though your statement opening and statement closing dates might vary a bit from month to month your payment due date should be on the exact same day of the month that time period of at least 21 days or sometimes even a bit longer between your statement closing date and that payment due date is also called the grace period And the reason why the grace period is significant is because if you pay your statement balance in full buy that due date like we just talked about you will not have to pay any interest charges but if you pay any less than your statement balance then the remaining unpaid amount will actually carry over and start to accrue interest now here you can see on my statement in this example that my payment due date is on January 25th which is actually in the following month after my statement closing date of December 28th and if I look at any future credit card statements I know that I'm going to have another payment due date on February 25th March 25th and then so on so when you think about it and this is probably the most important takeaway from this video so pay attention but for all my transactions I made on this credit card during my billing cycle from November 29th until December 28 that final statement balance of 48. 73 does not have to be paid back until the grace period which ends a few weeks later on the payment due date of January 25th so if I pay that full statement bounce of 48.

73 by that due date then I will not have to pay any interest that means the rule for paying your credit card bill is basically to pay your statement balance sometime during the grace period which is after the statement closing date but make sure to pay it before the payment due date and also give yourself enough time for that payment to post before the due date so that way you're not accidentally late also try to maintain a low credit utilization percentage like I talked about earlier by keeping your statement balance low relative to your credit limit and again we'll get to credit utilization in a few minutes here now also always make sure you read the terms and conditions and also read some reviews online of certain credit cards especially ones that Target customers with lower credit scores because there are some out there that might start accruing interest immediately and you should really look to avoid those so again always do your own research and watch out for those bad credit cards but also make sure you subscribe down below and check out some of the links I have down in the description that'll show you some of my favorite cards it's a great way to help support the free content here on this channel so thank you to all of you who use my links now a big mistake that I see people make a lot that really confuses them is that they log into their account and then they see that they have a payment due date that actually falls before the statement closing date so that seems like it goes against everything I just said but let me address that really quickly because it's actually an easy fix so in my example we already saw that my statement opening date was on November 29th my statement closing date was on December 28th and my payment due date was on January 25th and I can clearly see all the states lining up in the correct order on my actual credit card statement PDF that we downloaded but where people sometimes get confused is that they might log into their credit card account go to the home page and see something different so in this example they might see a statement opening date of November 29th a statement closing date of December 28th but then a payment due date of December 25th which Falls three days before the statement closes and that doesn't make any sense because it seems like there's no grace period like we just talked about so the easy fix here is that usually in an example like this the December 25th payment due date that you're seeing is actually relate to a previous billing cycle and if I download my credit card statement from one period before we could see that my opening date for that cycle was on October 29th my closing date was November 28th and then my payment due date is that same day of December 25th so the easy fix here is just to download your credit card statements from your account so you don't accidentally mix up and overlap separate dates from two billing cycles and that'll make things so much easier to understand in case there's any confusion I would say that if you ever have any doubt then just pay off whatever your issuer says your statement balance is but again just download and then check your actual credit card bill to confirm that okay so hopefully that clears things up but next we have to talk about another key term to understand when it comes to that payment due date and that is the minimum payment now back to my recent credit card statement with the closing date of December 28th I want you to pay close attention to the wording that chase and some other Banks might use here so like I said before we could see that it says New Balance or otherwise known as my statement balance which is going to be 48. 73 and then the payment due date is January 25th but in the middle there we can see that it says minimum payment due which is only forty dollars so to a beginner looking at that statement they might see the word do next to minimum payment and then they might assume that's all they need to pay now technically they would be correct so in order for your credit card payment to be considered on time which is what's important for your credit score you only need to make that minimum payment of forty dollars by the payment due date of January 25th in this example for Chase to report that as an on-time payment but a second main takeaway from this video should be the fact that you need to be paying both on time and in full which is what I constantly tell people here in my videos so by paying only the minimum payment we're not doing it the right way because the remaining 8. 73 difference between that statement balance and what we paid with the minimum that's going to be carried over to the next statement and start accruing interest charges that's why I always tell people to treat credit cards like a debit card and only use credit to pay for things if you already have money set aside in your bank account so you know that you can pay off your entire balance whenever you want to if you don't have at least some cash savings and you're using a credit card then trust me random expenses will pop up at some point and you may only be able to make that minimum payment and that's actually going to lead you into the whole of high interest credit card debt that can be really tough to get out of so we want to avoid that at all costs by at least having a few months of cash saved up so if you don't do this already make sure you start budgeting to get your spending under control and start to save up and I've got a free budget template and another video that I'll link to down below if you want to check that out after watching this now for the purposes of good credit habits I almost want you to ignore that minimum payment number and just focus on paying that full statement balance that's listed on your credit card bill by paying that by the due date every single month again your current balance is your live balance and it's good to know but that statement balance is what needs to be paid on time and in full by the payment due date to avoid any interest now if for some reason you end up missing a credit card payment by that due date you did not pay off your statement balance or at least make the minimum payment you're gonna be considered late which is a very bad thing for your credit score since on-time payment history is the top factor that accounts for almost 35 percent of your score you'll also get hit with a late fee of around 30 to 40 bucks like you can see here with this warning on my credit card statement but in a worst case scenario that you do miss a payment here's what you need to do first pay that statement balance if you can because that's what we want to get in the habit of doing but at the very least make that minimum payment so your account will no longer be considered late the good thing is that if you discover you missed a payment before it's 30 days past that payment due date it'll probably not be reported to the credit bureaus just yet so you shouldn't see a negative impact to your score but make sure you make the payment as soon as possible to avoid a drop in that score if it's 30 days late or longer than you could see your score drop by as much as 100 points or more depending on your situation and the longer it's unpaid the worse it gets so 60 days late is worse than 30 days late and 90 days late is worse than 60 days plus you're probably missing additional payments as each month passes eventually if you're late too long then that debt is just going to get sold off to a debt collection agency and it gets harder and harder for your score to recover from so never miss a credit card payment and again that's why we want to have plenty of cash savings and basically just treat credit cards like a debit card a quick bonus tip here too but if you're in that 30-day period after your payment due date and you realize you forgot a payment so you pay it off but you still have a late fee just call up your issuer and explain that this is a one-time mistake and you'd like that late fee waived if you're nice about it and if you've been a loyal customer then you could probably get that fee removed but again don't be late so set up auto pay if you need to or set up calendar reminders that'll help you remember to make those payments now the last three terms that I want to cover here in this video are also some of the most important to understand when it comes to using your credit card the right way and understanding your credit card bill so those terms are APR credit limit and credit utilization now APR stands for annual percentage rate and at the bottom of our statement we can see that this is the annual interest rate on your account the actual calculation of how interest is charged for any unpaid statement balances can be found online but the point I want to make here is that the APR is basically irrelevant when we're using credit cards responsibly and paying them off in full every month like I talked about in this video like I said if we pay our statement balance on time and in full buy the payment due date every month no interest is charged so the APR could be 24.

99 like it is on my card which is already high or the APR could be one thousand percent or even more but it doesn't matter because I've never missed a payment and I've always paid the full statement balance every month on all of my active credit cards over the past seven years or so that I've been using them sometimes there's zero percent APR offers that are going on but honestly I'd say in most cases just avoid those because they can do more harm than good for some people in my opinion at least for personal credit cards then for your credit limit that's simply the total amount of credit that the issuer is willing to allow you to use for making purchases on your card so on my statement here you can see that my credit limit right now on my Chase Freedom Flex card is for fifty six hundred dollars now I'm never coming anywhere close to using that full credit limit so I've never been worried about maxing out this card or running out of credit but I do pay close attention to this limit because it plays a huge role in credit utilization like I mentioned before so credit utilization is calculated as your statement balance divided by your credit limit and that percentage is calculated on a per card basis as well as across all your revolving credit card accounts combined after payment history credit utilization or amounts owed is the second most important factor affecting your credit scores since it accounts for about 30 percent of it so you definitely want to pay close attention to what that is when looking at your credit card bill a good goal to aim for is to keep utilization below 10 but ideally in the low single digit percentages so I like to aim for around one to two percent on most of my active credit cards that I use a lot and if we look at my example my statement balance was 48.

Related Videos

14:24

Do THIS For An 800 Credit Score (5 Steps)

Daniel Braun

479,900 views

10:59

What Capital One Doesn't Want You To Know

More Perfect Union

643,415 views

27:26

Is it Better to Sell Houses or Investment ...

InvestFourMore Real Estate

877 views

8:04

BEST Day to Pay your Credit Card Bill (Inc...

John Liang

1,311,560 views

8:07

Why Can't I Use Credit Cards If I Pay Them...

The Ramsey Show Highlights

1,117,491 views

11:52

Why You Should Buy Everything With Credit ...

CNBC

1,899,785 views

9:24

TSA PreCheck vs Global Entry vs CLEAR (Avo...

Daily Drop

204,974 views

16:16

Payday Routine: Do These 4 Things After Ge...

ClearValue Tax

1,047,401 views

20:02

ACCOUNTANT EXPLAINS The FASTEST Way To Pay...

Gabrielle Talks Money

211,765 views

19:20

How to Get A PERFECT Credit Score For $0

ClearValue Tax

986,772 views

51:26

How Credit Cards Work In The U.S. | CNBC M...

CNBC

2,019,241 views

24:40

How To Pay Off $40,000 of Credit Card Debt...

Aja Dang

90,957 views

16:46

What’s In My Wallet - Fall 2024 (My New St...

Daniel Braun

35,274 views

17:15

Why You SHOULDN'T Use A DEBIT CARD! | Weal...

Wealth Nation

1,065,291 views

22:47

I Ranked Every Credit Card Issuer (Here’s ...

Spencer Johnson

7,918 views

12:18

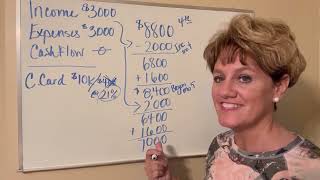

How To Pay Off A Credit Card with -0- Cash...

VANNtastic!

1,924,739 views

![[Full Guide] How to Climb the American Express Ladder in 2024](https://img.youtube.com/vi/g5PdY-Kcduw/mqdefault.jpg)

23:18

[Full Guide] How to Climb the American Exp...

John Liang

34,022 views

15:52

How Many Credit Cards Should You ACTUALLY ...

Daniel Braun

77,480 views

7:47

Getting Your First Credit Card

Five Minute Finance

387,681 views

15:10

How to Pay Off Credit Card Debt Fast: Top ...

ClearValue Tax

333,758 views