Market probably has tailwinds through early next year, says IG North America CEO JJ Kinahan

3.61k views1142 WordsCopy TextShare

CNBC Television

JJ Kinahan, IG North America CEO, joins 'Squawk Box' to discuss the latest market trends, impact of ...

Video Transcript:

for more on the markets and the retail trading activity let's bring in JJ kenahan CEO of IG North America who's going to single-handedly add to all of this uh this bullishness to the point where JJ it's getting you can cut it with a knife uh at this point which makes me uncomfortable but you don't see at this point you see almost all Tailwinds very few headwinds for the market well it it certainly does look that way Joe and I would kind of say that we probably have Tailwinds through maybe the State of the Union Address

in in January even or you know or when Trump makes his first speech in terms of uh you know what his plans are on the campaign Trail obviously every candidate talks about so many things they're going to do but we'll see what the actual priorities are when he does get up and speak I found you guys conversation uh you know before the break there really really interesting in terms of a couple of things obviously Bitcoin you know what's going on there has been amazing up 5% since president Trump got elected you know and now over

$100,000 we'll see if it can continue to carry that momentum and in terms of growing into earnings I think that is where most people's uh you know hope lies and the fact that again I think maybe there's even a misunderstanding about regulation people are like oh business people don't want regulations of course everybody wants regulations but when the government is employees are growing at a faster rate than private company employees people when they go to work want to do something so you just had so many more people coming in trying to do things trying to

do new regulations Etc and that really is where the issue was I think a lot of people this new Doge committee or you know whatever we're referring it to uh coming in and trying to just make the government more efficient not just on spending but in terms of you know how many people you have coming in maybe uh overlapping in what they're asking you I think that's what the business Community is really welcoming more than anything else and that's where I think a lot of the hope of us continuing to grow into earnings comes and

then the last thing I'll say to that is think about AI you know all hundreds of millions of dollars are spent on it the question six months ago is what are you going to actually do with this what can we show for all this spending and I think we're finally starting to see some of that not only in the tech industry but you think about medicine Etc that's where I think a lot of the hope for our next wave comes from also we T yeah we talked about that yesterday the if there's a one area

that for Humanity where AI uh just see multiple multifaceted benefits to to all of us and that's that certainly health I guess JJ you mentioned it grow into and and that's what we're talking about because I mean the Market's not cheap you follow mostly Trends so um I don't a lot of times it's hard to see a trend reversal uh coming but right you know with where how richly valued many things are and and I guess that the soldiers are catching up with some of the the generals some of the mag 7 uh but overall

we're still at pretty high uh levels historically in terms of valuing stock prices versus the underlying earnings can can that continue I think it can uh for a while what I'm really interested in Joe is going to be the last two weeks of the year to see if people start to take some profits this year when you know what the tax rate is not that we necessarily think taxes are going higher ET but are people going to take some money off the table heading into the year let's face it S&P 500 I believe was his

56th record yesterday that just you know you and I have been doing this a long time we know that that just doesn't continue to go and go and go so uh I like I said I believe that in a shorter term we can continue to do this but there may be some pressure at the end of the year I think there may be some pressure right after president Trump takes office you know you and I talk about the quite a bit the vix is certainly saying you know it's a very clear path barring some crazy

unforeseen event through the end of the year it with with a volatility under 14 or the vix measure I should say under 14 that's pretty amazing and you don't often see that you tend to see it in one of two things either we continue higher I mean the vix theoretically is working as it should when markets go up volatility should go down and that's what's happening but the other thing is when markets are stagnant also the vix stays at a low level so I'm not quite sure if maybe that's a little bit of it if

the perhaps the Market's just uh thinking we could also just stay sideways for a little while yeah talk about a trend though the vix is at 13 until it's until it's at 30 like the next morning well again as I said an unfor event in the shorter term again as we both thought these things it's not predictive it's not I don't I don't even see how you use the vix as as being predictive since you know it it's possible for so volatile it could be you saw that chart where all didn't we get almost to

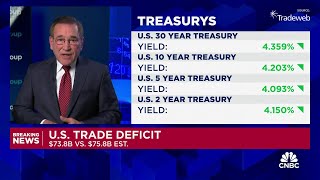

40 and and nothing even really happened I don't think you know last time it went up a gr SC a gr we did that one that was that was also overnight trade where the vix actually once markets opened Vick sold off that day but yes I agree it's not 100% predictive but it is also when you start to watch that in conjunction with you know you talked about gold you talk about bonds when you start to see people coming in we saw people turn to bonds yesterday with the uh you know uncertainty in France Etc

I don't think that's something that's going to continue but when you start to see these Trends over a few days with those three things together that's when you start to say hey maybe there's something here we just haven't seen that

Related Videos

3:57

Bitcoin's breakout is a precursor for equi...

CNBC Television

4,887 views

7:56

A.I. New "Dot Com Bubble" & Trump Tariffs ...

Schwab Network

255 views

4:26

The Javers Files: Millionaires dodge IRS c...

CNBC Television

4,335 views

5:49

Robinhood CEO Vlad Tenev: Bitcoin's gone f...

CNBC Television

4,231 views

4:48

Woo: It's impossible for DOGE to cut gover...

CNBC Television

1,424 views

14:20

Warren Buffet says a REAL ESTATE STORM is ...

Grant Cardone

4,909 views

5:32

Deregulation will be the 'secret weapon' t...

CNBC Television

8,931 views

4:13

Anca Alexandrescu 💙

Totul despre toți!

25,730 views

7:44

Pete Hegseth would be a great secretary of...

CNBC Television

2,022 views

5:28

Magnificent 7 'Cash Machine' Unlikely to S...

Bloomberg Television

45,942 views

33:07

Capital, Politics and Power: Ken Griffin o...

New York Times Events

7,191 views

3:39

Alphabet CEO Sundar Pichai on DEI backlash

CNBC Television

2,108 views

2:07

Weekly jobless claims higher than forecast

CNBC Television

1,463 views

9:15

France on the brink of economic collapse |...

Times Radio

123,351 views

9:54

John Bolton says Hunter Biden pardon is a ...

Sky News

118,357 views

3:15

Reacția șefului NATO, Mark Rutte, după dec...

Știrile ProTV

43,112 views

5:56

I don't want to short stocks when gross ma...

CNBC Television

18,095 views

6:43

We have a very selective consumer now, say...

CNBC Television

2,218 views

2:05

Cramer’s Mad Dash: Tesla

CNBC Television

1,887 views

3:34

Branch: Fed chair Jay Powell has to take a...

CNBC Television

955 views