Candle Range Theory | CRT Simplified

35.23k views4114 WordsCopy TextShare

ETM FX

To Learn More Join : https://www.launchpass.com/blackhatsociety/join

In Lesson we go CRT Candle Ran...

Video Transcript:

so in this lesson we're going to talk about what is CRT what is candle range Theory what is the why why does it occur what is it used for is it used for your higher time frame your lower time frame your entry your bias what are the pros and cons what is the good and bad and our etm modifications where after we explain the entire Theory We'll add a few things subtract a few things to make the trade more optimal so let's talk about the candle range Theory so as you can see you have a

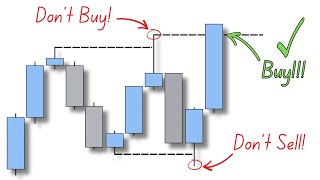

bullish candle and understand you'll be working within this candle the range will be formed in this candle by marking up your low and your high and what do this candle represent on the lower time frames this is simply a swing low and swing high so the low of the candle here is your swing low and the top of your candle is your swing high so now as you are waiting for your next candle the next candle starts off bullish but quickly flips and turns bearish forming a wick and now the candle starts off bearish and

still closes bearish so what are you anticipating for the next candle your next candle should fill out the range so should completely take over the range and absorb the liquidity underneath that swing low so what would be your trigger your trigger would be this current candle's low this would be a your trigger once price gets below this level you can anticipate price to reach for the second liquidity which is at the bottom of the range fully completing the candle's range candle starts off bullish flips gives you that Wick and closes bearish beneath your swing low

how this formation would look on the lower time frames as you can see you have your bullish candle your bullish Candle on the lower time frames will have consecutive swings so this would be the bottom of your candle and now this would be the top of your candle so now starting off the next candle the candle starts off bullish takes out the previous candle but quickly comes back inside of the range forming your change of character on the lower time frames now price comes back into the micro range and closes bearish so what are we

targeting now we are targeting that candle low and as you can see that candle low is the bottom of your breakup structure on the micro so what are you waiting for for the next candle you're waiting for the next candle to break below the previous candle next candle starts off bullish forms your Wick before you proceed please make sure you like the video and leave a comment this helps us a lot since this video is completely unmonetized so another variation is multiple candles inside of the range but the concept Still Remains the Same liquidity will

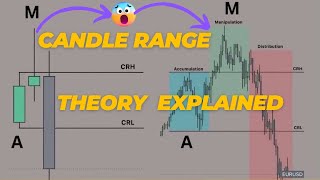

be grabbed and price will fill out the range so let's talk about the high volume continuation entry so once price breaks below the candle low you're instantly in a trade so it's basically a breakout trade and your target is the bottom of your range so once price breaks below this level you're instantly targeting this range and your entry is upon the breakout the basic functions of a candle candle has four functions it would be a candle open a candle low a candle close and a candle high so as you can see this is how this

candle will translate on the lower time frame so you would have your candle open either you will get an accumulation or price would instantly go for your manipulation which in this casee would be your candle low and now you have your distribution which is heading towards making your candle high you can see here and a uh pullback for your candle close and a good example would be here you can see this is your candle open right here you have your candle open candle high is made via manipulation and price distributes makes your candle low and

a slight pullback for a candle close so to start off our lower time frame expectations let's start off with our instant internal rejection and what we're going to focus on here is our third candle the slower time frame formation is going to form within this third candle so what makes this instant internal rejection different is that once this candle opens it instantly targets a internal rejection internal liquidity so in this case case price is going to instantly Target this extreme Supply so once the candle opens price instantly targets that extreme Supply and rejects and covers

the entire candle's range so let's talk about instant internal rejection so what do we have here we have a bullish candle that's trapped in a bearish candle's range and what happened liquidity has been taken so price took out the liquidity price took out the liquidity and Clos back inside of this candle's range so now let's target this candle's range is high this would be the candle range is high so now we have our candle range so where would our trigger point be our trigger point would be in the current candle's high so this would be

our trigger point so now what do we do we go on the 1 hour time frame and when trading the instant internal rejection what are we waiting for we're waiting for the candle to start off instantly targeting an internal level what do we have here we have a bullish order block let's mark up our bullish order block and what can we anticipate this candle this next candle to open instantly bearish Target internal liquidity and flip the candle as the candle opens right here you have a candle flip right here and instantly targeting this level therefore

targeting this level as well and closing out the entire range so in case you're still confused let's go over this one more time so what do you have here you have your bullish candle this is your high and this is your low and What's following is a bearish candle so what happened after this bearish candle closed you conducted that price took out the high took out the liquidity that was resting above the previous candle and closed back inside of this candle so this would be your candle Clos so now when looking at it from a

CRT standpoint you're targeting your candle's range so the bottom of the candle will be your candle's range so now what you're looking for is for the next candle to close out this range by close out I mean for the next candle to complete this range so now let's look at it from a micro standpoint and specifically looking at instant internal rejection so the next candle starts off bullish so now this candle is bullish and what happens next price targets a previous level so if you look right here you would find a internal liquidity level right

here so here you have an internal liquidity level somewhere like this price will reject from this internal liquidity level and drop down so so what you would have at this point is you would have price opening but once price gets back to the candle open this bullish momentum turns into a wick so let's say price started off bullish but then quickly turned bearish so when that happens a wick is formed now you have a wick and this is the point where we at right now once price got back to the low price is currently a

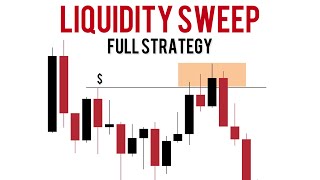

wick from a macro standpoint so where would your target be your target is this low right here so once price gets below this low right here you're targeting the entire range now price gets below this level and closes out the entire range and this is how you get your macro bearish candle closing out the entire range so what was the important thing the important thing was as price open price was in a rush to grab sell orders at an internal level of liquidity so let's talk about the instant external sweep so Price's main objective is

to grab external liquidity before attacking your trigger point therefore closing the range so as you can see here right grabs liquidity via sweep and how it would look on your macro is price would start off bullish but quickly the candle will flip and that bullish movement will end up as a wick so now when price approaches your trigger point the next level is closing out your range so that would be your target so let's talk about the instant external sweep so what do we have here we have our bearish candle trapped inside of our bullish

candle and we have our bias which we'll cover a second an extremely important topic that a lot of gurus leave out so you have your liquidity sweep here this is where the liquidity was swept and this is the bottom of the range actually let's color code it and let's mark our trigger point now you don't have a lot of range to work with and we'll cover that in a little bit but this is is the range that we have to work with from here to here now let's go on the 1 hour time frame so

what is our instant external sweep so the goal here is for price to quickly grab liquidity you have a swing high right here price grabbing liquidity real quick and instantly targeting your level and one PR gets below this level you can confirm this level as well let's mark our liquidity as you can see once the new daily candle open price instantly grab the liquidity and now what is our Target our Target is right here this will be our trigger point and the of the range will be right here so in case you're confused let's cover

this one more time so right now we're going to draw out this candle we're going to draw out this previous Day candle obviously we're anticipating the trade within the next candle so this candle starts off bullish price quickly drops makes the low and closes right here so now that you're anticipating your next candle price can take out either previous day's level of liquidity or price can take out current day liquidity so let's say this the the new candle the new candle that starts off right here candle forms a swing and gets below it so price

can now either Target this level of liquidity or the previous days swing level of liquidity a lot of times there's only one present so the good thing is you only have to Target one level of liquidity let's say now price takes out current Day level of liquidity and drops back into half the range gets below your trigger point right here price gets below your trigger point you're in your trade and your target is to cover the entire range what about context this is something a lot of gur ruses fail to mention when teaching the CRT

and if you're actually serious about trading this strategy in the live market and not just marking up hindsight charts I would suggest you apply it so as you can see here you have your bullish Trend so now you have a bearish candle that quickly turns into a bullish candle and now you have your candle range so you have your candle low and your candle high so now you have your range set so a lot of Traders will anticipate a lot of bullish momentum why because based off the past two swings the trend is bullish the

order flow is bullish so now you get a bullish candle that quickly comes back inside of the range then that bullish momentum turns into a wick and the candle closes bearish so even though you got a bearish candle still a lot of Traders will anticipate bullish momentum based off the previous two swings so now what happens the next candle starts off bullish inducing Traders into taking uh buy positions going long then the candle quickly flips and closes bearish and why did that occur if you look to the left you'll see an extreme Supply level and

that level will stop price from continuing the bullish Trend and quickly turning bearish so let's talk about another variation you see you have your bullish Trend and now you have a bearish candle that flips and turns bullish and now you have your range so you have your range low and your Range High so as you can see here even if you look to the left you can see that price broke structure so not only you were bullish on your recent swings which is your previous two swings you are bearish on the macro as well on

the complete overview because price broke the previous Peak so now your next candle starts off bullish but quickly comes back inside of the range and closes bearish what would your next candle be you can see the candle starts off bullish quickly flips and close closes bearish and why did that happen because as this whole formation was occurring price took out major liquidity and closed back inside of the range with the second candle so the third candle was a high probability candle to the downside so let's talk about context so as you can see here if

you ask a lot of retail Traders they would anticipate this next candle to be bullish they would anticipate this next candle to be bullish why because they would think that this is a character change and now this is a start of a bullish Trend not only that they would think that this is a rally drop rally something similar to let's say this where you have a drop rally drop here you have a drop rally drop here you have a here we actually had a reversal here you have a r drop rally so they would anticipate

a formation like this but why are we anticipating CRT because as you can see this bearish candle is trapped within this bullish candle price took out liquidity and came back inside the range and closed and gave you enough range to work with so you have this entire range to close out what's another C clue another clue is that this candle took out major liquidity and not only that it took out major swing liquidity price came back inside of macro range as well so you look at this swing high right here this swing low this is

the macro range so not only that price came back and closed back inside of this candle's range price took out major liquidity and came back inside of the macro range so this is the high of the range this is the low of the range and now let's look at our trigger point B so this would be our trigger point so now let's go on 1 hour so what are the possibilities here obviously you have have your range right here and you can instantly Target the extreme so this would be the extreme of this range and

you can use the entire swing for a more of a macro range so now have a extreme level right here so now you have your two options you can take a short right here or you can take a short right here or you can wait for price to reject from one of these two levels and come back to your trigger point and take an entry at your trigger point on Sprite breaks below this level so let's take a look at this example so here you have your range you have your CRT candle high and you

have your candle low and this where the liquidity was taken and here is your trigger point so what would stop a lot of Traders for even looking at price from a bearish standpoint well if you look at it right here price took out liquidity so even smart Money traders are getting destroyed here so price took out liquidity and this would be considered a return to origin this would be your RT and not only that you can look at it from a subordinate resistance standpoint price is rejecting in this level the zone right here is rejecting

price the price is rejecting from the zone so a lot of Traders will be bullish here and will completely ignore what's going on here but why are we bearish not only that we have our CRT formation but that's not the only reason one if you look to the left you'll see a bearish order block here and price is rejecting from this level so this is one reason now if you want to add even more context and this one is the actual more important look at this right here price is rejecting from this swing here and

again you're wondering what what's what's the was the context behind this specific swing you can look at it from this standpoint I broke structure came back and retraced so you have a rejection not only that if you look at it from a lower time frame standpoint let's say we go to the 2hour you can see that price is rejecting of structure so price tried to reject of this level once twice and broke structure so you can see that price is finding rejection this level so far as a lot of Traders they wouldn't be looking at

this situation as a bear scenario but as you seen via as you seen via context that we have a bearish order block pushing this entire motion down not only that you have your immediate context right here so these are the reasons for you be looking for the next scandle to be bearish see once price got below this level it instantly dropped so this is the etm modified model double scoop as you can see price starts off bearish and instantly attacks your trigger point so you would anticipate price to continue to the downside and if you

look to the left you would see that price is bearish and you would anticipate price to fully close out the range but no price has other ideas and price instantly turns around bullish and that bearish momentum is gone so now what happens next now price revisits that area again and fully closes the range and that bullish momentum turns into a wick so in case you're confused let's go over this one more time obviously this is your previous day and now we're anticipating our next day with our candle open right here so what happens remember first

let's mark up our trigger point which would be right here so price starts off by taking your trigger point out and instead of continuing to the bottom of the range by price comes back for a second price come back and looks for either external liquidity or internal liquidity so let's say in this case price grabs external liquidity and then comes back your trigger point for the second time and once price comes back to your trigger point for the second time you can anticipate a smooth ride back to close out the range so now let's look

at this example one more time but now let's use our double scoop entry model so this would be the bottom of your range first let's mark up our trigger point so this will be our trigger point will be the bottom of the range and this will be the top of the range now let's go on to 1 hour so what are you expecting when using the Sentry model You're Expecting price to reach your trigger point but instead of continuing to the downside and closing out the range you expect price to come back and look for

internal liquidity before visiting the trigger point again and continuing to the downside to close out the range so here your price reaching your trigger point but instead of continuing to the downside price came back looking for internal liquidity so obviously you can mark up the extreme of your range right here and expect a rejection right here or if you're not comfortable you can always go on a lower time frame and look for a order block so use the order block right here and now that price reach your uh trigger point again you're targeting the low

of your range so if you're really serious about trading and ready to take the next step make sure you join our Discord Community where we cover a new lesson every single week and a new entry model every single month so let's talk about targets and a lot of gurus who teach the strategy always leave this out and what you need to understand as a Trader you get paid on your exits not your entries so here you have your CRT and here you have your trigger point so again your target is the bottom of the range

to close out the range but what is the high probable exit what is the highest probability exit now let's go into 1 hour let's color our trigger point so yes understandable that the target is to close out the entire range but as far as probability goes your highest probability exit would be the 50% on your trigger point all the way down the bottom of the range mark up the 50% and this would be your highest probability Target so this could always be your first Target that you reach and you take partials and before you go

break even and Target your second so let's say you enter the trade right here price reaches the 50% here you take up 50% of your trade and move your stop- loss to break even and now you're targeting a risk free all the way to the bottom of the range and let's look at this example this happens pretty frequently price grabs internal liquidity and now it's your target point and now price reached the 50% socker this is the 50% look what happens next price reached the 50% came back closed the day outside of your range and

now the next day is when price filled out your entire range and sometimes price reacts off your 50% and instantly changes Direction so this is what I mean by the 50% here is the high probability exit point now again price could reach your target down the line or Price could take you out and you look for another entry or whatever it may be but the highest probability is the 50% let's look at another example of your targets so here you have your trigger point you have the top of the range and here you have the

bottom of the range now let's go on the one hour so again what is our first Target swing low swing high and this is the 50% between your Target and the bottom of your range now this is your DP the smaller now let's take a look as you can see once price reach the 50% price reversed so this is your first danger point and any danger point is a point where you take profit and the reason we look at Targets this way is because of the probability so your first your first Target should always be

your fair price because this is where price is even now what once price gets to your discount this is where price could also be bought at so these are all your levels of danger your third target would be your external liquidity which is at the bottom of your yourt range as you can see a lot of times price finds it easy to get to your first Target and a little bit harder to get to the second Target and you can see even harder to get to your third target hope you guys enjoyed this video please

make sure you like share and subscribe and make sure you leave a comment

Related Videos

15:05

Candle Range Theory Explained and Simplifi...

Smart Risk

373,986 views

14:40

How a Simple Candles Strategy Achieved a 9...

CodeTrading

103,977 views

14:29

The 8 Second Chart Decoding Trick - No Ind...

Trader Dale

74,809 views

15:55

Always Wait For THIS Before Entering Trade...

JeaFx

157,819 views

1:12:38

Complete Liquidity Course (Step By Step)

ETM FX

24,240 views

39:19

Support And Resistance Didn't Work Till I ...

Rayner Teo

1,884,492 views

21:49

Convert TradingView Indicators into Strate...

Michael Automates

324,262 views

48:15

Reading Candlestick Charts Was HARD Until ...

Ross Cameron - Warrior Trading

684,867 views

20:08

Liquidity + Structure = Profit

JeaFx

170,182 views

25:19

Best ICT Trading Strategy! (Quit Your Job ...

Faiz SMC

30,583 views

14:26

ICT Candle Range Theory (CRT) Explained: E...

Pro Trading School

89,181 views

12:42

1 Indicator, 3 Uses! Most Powerful Trading...

PineTrades

155,033 views

21:04

Everything to Know About A Candle (Candle ...

ETM FX

13,650 views

18:19

🔴 1-2-3 ORDER BLOCKS Trading Strategy Ban...

Trader DNA

83,496 views

54:56

How to Read Candlestick Patterns (Step-by-...

Ross Cameron - Warrior Trading

281,560 views

18:34

Liquidity Sweep In-Depth Strategy

ETM FX

51,406 views

13:40

The Underrated Excel Tool You’re Missing O...

MyOnlineTrainingHub

32,427 views

55:11

Master This ONE Candlestick Pattern TODAY ...

Ross Cameron - Warrior Trading

941,147 views

40:10

Trading Psychology - Dr David Paul

FinPort

3,685,525 views

55:18

How to Read Candlestick Charts (with ZERO ...

Ross Cameron - Warrior Trading

2,472,440 views