Money and Finance: Crash Course Economics #11

1.71M views2086 WordsCopy TextShare

CrashCourse

So, we've been putting off a kind of basic question here. What is money? What is currency? How are t...

Video Transcript:

Adriene: Welcome to Crash Course: Economics. I'm Adriene Hill. Jacob: And I'm Jacob Clifford.

And today we're going to talk about money and finance. Adriene: I know we said in the first episode that economics isn't really about money. .

. Jacob: Economics isn't about getting rich quick, but it all boils down to trading things you have for the things you want. Adriene: Like, I've got this giant zucchini, but I'd love that piece of pizza.

Want to trade? Jacob: No way! [Theme Music] Imagine you live in a world without money, and you're a dentist that wants to go buy a car.

First you need to find a bunch of auto workers who need dental work. And if these workers don't want dental services and prefer being paid in something else like flat-screen TV's, then you have to find TV manufacturers that have toothaches. Try posting that on Craigslist.

. . This is called the "barter system", and it takes a lot of time and energy.

Of course, many people still barter for stuff, but for most transactions, we use money. Which is a way more efficient way to do business. The people who really need dental care will pay you with money, which you can now use to buy a car.

Economists point out that money serves three main purposes. First, it acts as a "medium of exchange". It's generally accepted for payment for goods and services.

Now, that medium of exchange means we're not stuck in the barter system. Next, money can be used as a "store of value". The reason why a dentist doesn't normally accept fruit or baked goods is because you can't save those things up to go buy things like cars.

Plus, bananas go bad pretty quickly in a safe deposit box. Money also serves as a "unit of account". We don't measure the value of cars in bananas, muffins, or root canals.

Instead, we use money because it's a standardized metric that allows us to measure the relative value of things. Adriene: Most people assume that money is just cash and coins, issued and endorsed by a government. Coins have been used for thousands of years, and they're a great example of money, but technically money is anything that's used as a medium of exchange.

For example, cigarettes were used as money in prisons until smoking bans were put in place. Nowadays, prisoners use postage stamps and even small packages of mackerel as currency. Animals like cattle and sheep, also sacks of grain, all these have been used as money.

Some societies even used feathers or shells. The indigenous people on Yap Island in the Pacific Ocean used money called "rai stones". These were large doughnut-shaped disks made out of limestone.

The largest ones are around ten feet wide, and weigh four tons. The point is what economists consider money is anything that's accepted as a medium of exchange. And that's changed a lot over time.

Today, cash and coins are often used as money since they're easy to carry around, physically durable, and hard to counterfeit. But a lot of money today doesn't end up in anyone's pocket, or wallet, or duffel bags, or even wheelbarrows. It moves around electronically.

Increasingly, people get paid in the form of checks or direct deposits into their bank. A lot of our money isn't physical. It's digital.

It exists on some bank's computer. And as long as that computer is secure, and the zombie apocalypse doesn't permanently knock out the power, and your nation's monetary system is functioning as it should, those electronic dollars do all the things they're supposed to do. Another form of digital money that you often hear about is Bitcoin.

Bitcoin is a virtual currency that is not issued or regulated by a specific country. But since some people accept it as payment, many economists consider it money. Unlike other electronic currency, Bitcoin doesn't involve a bank, so people can, in theory, buy things more anonymously.

This appeals to people who don't trust central banks, and also people who want to buy illegal stuff online. That illegal trade means law enforcement and regulators are also very interested in Bitcoin. Bitcoin isn't only for internet drug deals though.

There's a lot of speculation in Bitcoin, meaning people buy up Bitcoins, hoping to turn a profit on them. This makes Bitcoin more of a speculative asset, and limits its use in buying and selling actual goods and services. Could Bitcoin or another virtual currency be how everyone pays for things in the future?

Who knows! But if anyone wants to give me 10 Bitcoin for this zucchini, we've got a deal. Jacob: There's kind of a glaring question here: what makes these pieces of paper so valuable?

Well, in the past, each dollar issued by the U. S. government was redeemable for a specific amount of gold.

That was called the "gold standard", and it meant that the government couldn't issue more money than it had in gold reserves. Back in the 1930's, the U. S.

decided to move off the gold standard and some people freaked out about not having something tangible to back our money. But it's important to remember that money, whether it's cash, or gold, or small pouches of mackerel, is all about confidence. The Nobel Prize winning economist Milton Friedman said, "The pieces of green paper have value because everyone thinks they have value.

" With that in mind, a gold standard, or even a mackerel standard, might not make money more valuable or reliable. A lot of economists agree with this, which is why no country uses the gold standard. There are calls by some politicians to bring it back, but that's probably never gonna happen.

Sorry, Ron Paul. Adriene: Okay, I know we said economics is not about the stock market. But now it's time to explain what it is, and why it's important.

The stock market is just one piece of something much bigger: the financial system. To understand the financial system, you need to picture two different groups. First, you have "lenders".

Sometimes these are corporations with a bunch of cash, but lenders can also be ordinary households, people like you and me. Us regular folks are gonna need money in the future to retire, or send our kids to college, or go on a vacation to Yap Island. So we need a way to turn the money we have now into more money in the future.

The second group is "borrowers". There are several different kinds of borrowers. First you have other households who want to borrow money to buy stuff like a car or a house.

You also have businesses that have a great idea for a new product, but that have a problem. They need money to make the product, and they'll have money when the finished products are sold. But for now, they need to borrow money to invest in capital - things like machinery, tools, and factories.

And they'll pay it back once they make some sales. Basically they need to buy stuff to produce other stuff. Third, you have governments who need to to borrow money because they're spending more than they're bringing in.

So you have lenders who have money now and want to turn it into more money in the future. And you have borrowers who need money now and will repay it in the future. The financial system is a network of institutions, markets, and contracts that brings these two groups together.

Lenders put money into the financial system, which loans it out to borrowers. These borrowers pay back those loans with interest, which makes it worth the lender's time. Let's go to the Thought Bubble.

There are three ways this exchange takes place. The first is banks. A lender deposits money in a bank, and then the bank turns around and loans that money to a family who wants to buy a house or a business that wants to expand.

As those borrowers pay the interest on their loans, the bank takes part of that money to cover their costs and passes the rest along to the depositor. The second way lenders an borrowers link up is through the "bond market". A government or large corporation that needs to borrow money will sell bonds to lenders.

A bond is basically an IOU in which the borrower agrees to pay regular interest payments and promises to repay all of the money back at a set date in the future. If that lender decides they'd rather have cash now, they're free to sell that bond to another party. The third way lenders and borrowers link up is through - you guessed it - the stock market.

Say Jacob and I want to expand our lemonade business, but we don't have the money to do it. We could sell stock, which is basically slices of ownership in the company. Households get the stock, and we get the cash.

If our company profits in the future, and we become lemonade moguls, we'll share some of those profits with the shareholders, or the shareholders can sell the stock at a higher price. Either way, they make money if the company's profitable. Thanks, Thought Bubble!

So banks and bonds have something in common. They're dealing in something called "debt". If you get a loan from a bank, or if you're a government that sells a bond, the amount you must repay is set.

In almost all cases, you're obligated to pay back the amount you borrowed with a set amount of interest. Stocks, on the other hand, are known as equity. If a company enjoys high profits, shareholders get more money.

If a company goes bankrupt, shareholders may get nothing. In the news, you'll hear about changes in the Dow Jones Industrial Average. But fluctuations in stock markets are not reliable indicators of how the economy's doing.

Often changes in the stock market are reactions to real, or just perceived, changes in economic fundamentals like consumer confidence, the unemployment rate, and GDP growth. Bonds and stocks also have something in common. They're traded on markets for financial instruments.

Bonds are debt instruments, and stocks are equity instruments, but they're both pieces of paper that are traded on markets with many buyers and sellers. Banks, on the other hand, are financial institutions. With the help of the FDIC, they safeguard our money while making loans to individual households and businesses.

Jacob: So why do we even need this complicated financial system? Why don't households take their savings and lend them out directly? Well, if you want to loan out your life savings to your neighbor so he can launch his artisanal smart phone business, go for it!

But that's a pretty risky bet, so you're more likely to use a financial system. Financial markets, with instruments like stocks and bonds, allow borrowers to crowd source the money they need to borrow. They raise their capital from lots of investors and spread the risk around.

Banks do the same thing. They accumulate small deposits from thousands of people and use that to make loans. It's like Kickstarter except better because you get money as opposed to an earnest thank you email.

From the lender's point of view, a financial system allows you to spread your savings over dozens or hundreds of different loans. A few companies might go bankrupt and a few people might pay back their car loans, but those losses will be offset by borrowers who do pay back their loans. You don't have to put all your eggs in one basket.

Adriene: So that's money in the financial system. The thing to remember here is that this stuff is not just an abstraction or someone else's concern. Almost all of us are lenders and borrowers at some point in our lives, and understanding lending and borrowing is a big deal.

While it might seem like you're borrowing from a faceless institution, you might be borrowing my money from that faceless institution, and I'm gonna need that back if I can't get anyone to accept this zucchini as payment. Thanks for watching! Jacob: Crash Course Economics was made with the help of all these nice people who believe in some way that there's value in those green pieces of paper.

Your green piece of paper can help support Crash Course on Patreon. You can help keep Crash Course free for everyone, forever. And you get good rewards.

Thanks for watching! DFTBA!

Related Videos

11:25

How it Happened - The 2008 Financial Crisi...

CrashCourse

4,462,041 views

9:25

What's all the Yellen About? Monetary Poli...

CrashCourse

1,873,137 views

12:09

Intro to Economics: Crash Course Econ #1

CrashCourse

7,954,416 views

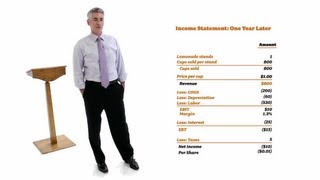

14:33

Personal finance: How to save, spend, and ...

Big Think

2,505,251 views

13:50

This Chart Predicts Every Recession (it’s ...

Hamish Hodder

530,090 views

43:57

William Ackman: Everything You Need to Kno...

Big Think

12,570,607 views

29:56

How is Money Created? – Everything You Nee...

ColdFusion

5,499,096 views

29:58

Macroeconomics- Everything You Need to Know

Jacob Clifford

3,481,268 views

19:02

How Banks Work

Alux.com

749,727 views

53:18

The Retirement Gamble (full documentary) |...

FRONTLINE PBS | Official

8,353,528 views

11:50

Politics Professor Explains the Electoral ...

Hillsdale College

151,472 views

10:11

Imports, Exports, and Exchange Rates: Cras...

CrashCourse

2,436,884 views

6:10

Banking Explained – Money and Credit

Kurzgesagt – In a Nutshell

10,344,775 views

17:10

Adam Smith: The Grandfather Of Economics

Economics Explained

474,052 views

8:06

ACCOUNTANT EXPLAINS: Money Habits Keeping ...

Nischa

10,143,529 views

10:01

Brooks and Capehart on what's ahead for th...

PBS NewsHour

342,574 views

34:47

1. Introduction and Supply & Demand

MIT OpenCourseWare

2,514,089 views

16:17

Financial Literacy - Full Video

izzitEDU

1,539,965 views

17:34

Explained | The Stock Market | FULL EPISOD...

Netflix

14,858,855 views

23:17

Equipping Your Kids to Handle Money - Dave...

Focus on the Family

75,665 views