Real Estate For Beginners

2.4M views2032 WordsCopy TextShare

Kris Krohn

Real estate has a language to it. And if you understand some of the most important basic words and p...

Video Transcript:

Hey friends, Kris Krohn here. And today we're talking about real estate for beginners. Real estate has a language to it.

And if you understand some of the most important basic words and principles, it can help you understand how to make a lot of money. So, you want to make a lot of money in real estate and you got to learn some of the basic language. So, what I'm going to do today is I'm going to take this daunting vocabulary.

And I'm going to help you understand some of the basics of it that will help you really get into the whole game of real estate. So, what I've got is I've got some different words on the screen and what I'm going to do here is I'm going to map out what they are and what they mean. And I think that'll be really helpful for you.

So, first of all let's start with the most basic word up here. It's a home. Now, I want to be really clear that in real estate we've got different names for this.

When we're buying a piece of real estate, you have a lot of different types. One of them is called a single-family home. S-F-H.

And you'll see that abbreviation, if you look in the ads. Single family home just basically means this is a regular home that one person is meant to rent. Now, all of a sudden if it is a home that is split and has two doors, they have a different name for it.

It's called a duplex, okay? And then of course if you have one home with the single door but it's connected to a whole bunch of other homes just like it, it's probably called a condo or a townhouse. So, for me, I specialize often in this whole game of single-family real estate.

So, S-F-H. Single family homes, right? So, that's what we mean by home.

Next I want to talk about the word equity and I want to talk about the word mortgage. Okay, if I want to buy a home and let's say this home is $150,000. U.

S. Then most people don't have a $150,000 saved up in the bank. How our young people buying houses?

Well, what they'll do is they'll go to a bank, they'll give the bank a little bit of money and the bank will give them a mortgage. The mortgage is and another name for that is a note. That's where the bank says, "Alright, we looked at your job history, we looked at the money you're making, we feel comfortable with you, we're actually going to give you a mortgage.

" Which means we're going to lend the money you don't put up. " So, let's just say for a moment, you put up the typical 3%, 5% but for easy math today. We'll call it 10%.

Let's say you came with $15,000. Then the mortgage would be for the difference. So, 150 grand minus this 10% down.

Down as in down payment. Would be the remaining balance of $135,000. So, I put $15,000 of the down payment.

And there was $135,000 mortgage. Now, that mortgage is going to come with an interest rate. Because the bank's going to say, "We're not giving you our money for free.

You got to pay that back over time plus interest. " So, the bank says, "We're going to do a six percent interest rate. " And you're thinking, "Okay, well if I'm paying this back over 30 years and I've got that interest rate", they'll do some math and they'll tell you essentially what your payment's going to be.

Let's just assume for this example that your payment is $800, okay? That's just a guess out of the wild blue. This $800 is your mortgage payment, okay?

Now, we've got a home. It's a single-family home, it's not a duplex, not a condo, it's not a triplex or multifamily it's just a home with one door and a doorknob and a happy family inside their windows and a chimney like that. Now, let's say that you have this home and you decide we're not going to live there.

We're going to rent it out. Another word for rent is lease. So, we are going to lease the home.

My mortgage is $800 but I might get my renters to pay $1,000 a month. My mortgage payment is 800. My rent payment or my lease is for $1,000 a month.

So, this is my rent payment. This is my mortgage payment. And the difference is that if you have to pay the bank 800 every month but your renter gives you a thousand, there's some leftover money.

How much? A thousand minus 800 is 200. What do we call that?

That's called cash flow. And cash flow is good. So, you buy a property.

And let's say all the sudden that this house. . .

I'm going to throw you a zinger. Now, this house is worth $200,000. It's worth 200, you bought it for 150.

You put $15,000 down, you've got a mortgage for 135 but it's worth 200. Here's the question. How much equity does it have?

What's equity? The equity is the difference between what it's worth and what you owe. So, in this case 200,000 minus the 135 is $65,000 of equity.

Does this awesome. Are you learning this language? You can rewatch this video.

These are the basics that you want to get really comfortable with. And literally in the beginning, just copy me. Just copy what I'm saying because I'm telling it to you the right way, okay?

So, I've $65,000 of equity, you might say, "But Kris, what about my $15,000 that I put down? " That's not part of the equity. Because you would get this $50,000 out plus the 15 you put down.

The equity represents the total amount between what it's worth and what's owed. By the way, when you do investment real estate, you're looking for equity and you're looking for cash flow. So, I wanted to, you know, teach you these basics, so that you understand equity is a very good thing.

Cash flow is a really good thing. Now, before we get to these 2 real quick. Let's just do a quick summary on the story that we told so far.

This is a home. It is a single-family home. Single dwelling.

Meant for one family. It's not a condo, it's not a townhome and it's not a duplex, it's not a triplex, it's not multifamily. And this house, at the time, I bought it for 150.

It was worth 200. I bought it because it had equity into it. Right there I bought it it had $50,000 of equity.

200 minus 150. But then I put $15,000 down to now have a mortgage of a $135,000 and my total equity between what it's worth and what's owed now is $65,000. My mortgage payment is 800 a month.

But I chose to rent it to somebody else. They're paying me a thousand a month. That leaves $200 a month left over every month.

That's called cash flow. Now a couple more things that you'll want to know so you can tell the full story. This $800 a month, is that you're P-I-T-I?

What Kris? Principal Interest Taxes and Insurance. A bank will normally wrap all four of these core components into your mortgage payment.

The reality is that your mortgage payment on this 800 might actually only be like 720. The other $80 might include principal interest and then taxes and insurance. So, your payment, when you make a payment every month, a part of it goes to principal.

That means paying off this 135. A part of it goes to interest because the bank's got to make money. A part of it has to go to taxes.

They'll actually say, "Hey, we don't. . .

You need to make sure you pay your taxes. " Because if you don't then the county will put a lien on this property and that will encumber the property. Encumber means they're going to weigh it down and the bank says that's a threat to us because we only want our loan to be the loan on it.

So, every month we're going to take a twelfth of your taxes every month. And after a whole year, we will have collective a year's worth of taxes. And we'll have it automatically paid off so that you don't get behind on paying your taxes.

And then insurance. The bank says, "Dude, the house could burn down. You guys could be crazy responsible or freak of nature, act of God, something wild happens.

If there's a flood, an earthquake. And if that house gets hurt, we need to know that our money's not just lost. So, we're going to have it insured.

" Banks will not give you a loan without insurance. So, P-I-T-I stands for Principle and Interest. That's the core payment for paying this off over time plus the interest.

T-I is taxes and insurance. To make sure that the property doesn't get encumbered with unnecessary debts added on that could threaten their mortgage position. And insurance just means that it's covered.

Now, we've just spent this video training you on all the basic language of real estate. Here's the last one. Buy low, sell high.

What does that mean? I don't want to take it for granted. You need to know it.

Buy low, sell high is encapsuled in this very basic idea that it was worth more and I paid less. And if I paid less and then sold it for more, I would what? I'd make money.

But the question is, how much of a margin? New word, margin. What is the difference between this and that?

For example, $200,000 represents my value. $150,000 represents what I paid. I did put some money down but leaving that out of it, there's $50,000 of profit to make.

When you go to sell it, if you were wrong on your margin here and you could only sell it for a $160,000 then you're like, "Well, Kris, there's still at least a $10,000 difference between 160 and 150. " And then I would say, "What about realtor fees that are 6%? " 6% of 160 thousand it's almost $10,000.

So, that's now wiped out because there's costs when you sell this stuff, too. So, you think about all these things. So, when you buy low, it's like I got to buy low enough to create a tangible benefit when I sell high.

I got to buy low enough so there is a significant difference. So that after all my costs, I still make enough money that says, "This was worthwhile for me. " Friends, this is the story of real estate investing.

That's what home, mortgage, equity, lease, rent, principal, interest, taxes, insurance and buy low, sell high all mean. And if you get this languaging down, you're going to have a 6 month head start on me that just was confused after my first 6 months of working with my mentors. Let's just give you the unfair advantage and get you rocking it out now.

Watch this again. Practice it, learn it. Hey friends, thank you so much for watching this video.

I hope this information was very very useful for you. Helpful for you in learning the basic language of this incredible world of real estate. Listen, it's it's foreign stuff but if you learn it, you can do extraordinary things.

And it doesn't get a whole lot more complicated than this. There are more advanced terminology. But right here we've covered all the basics.

I hope you enjoyed this video. Like it if you did. Please share it with anyone else is trying to get in the game of real estate.

And for you, make sure you're subscribed. We got a lot more to teach you, got a lot more to share and as always, check out my website. Descriptions in the link below.

I love giving people shortcuts to creating a lot of money right now.

Related Videos

13:57

How to be a SUCCESSFUL Real Estate Agent i...

Ryan Serhant

1,963,990 views

16:46

The ULTIMATE Guide to Getting Started in R...

Kris Krohn

1,346,161 views

13:03

Real Estate Vocabulary

Kris Krohn

425,941 views

14:54

The Ultimate Starter Guide To Real Estate

Kris Krohn

31,853 views

9:40

How to Get Started in Real Estate with NO ...

Grant Cardone

507,001 views

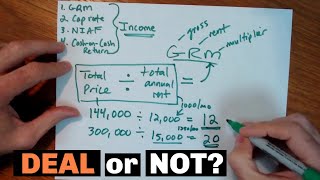

35:11

How to Analyze a Rental Property (No Calcu...

Coach Carson

2,258,832 views

21:55

The TRUTH About Being a Real Estate Agent:...

Chloe de Verrier

387,618 views

25:24

Tips and Advice Every New Real Estate Agen...

Tom Ferry

747,750 views

10:31

One of the Greatest Speeches Ever | Steve ...

Motivation Ark

35,138,367 views

16:06

7 Principles For Teenagers To Become Milli...

Iman Gadzhi

5,570,733 views

17:17

How to get your Real Estate license and be...

Graham Stephan

738,319 views

27:44

How To Buy Your First Rental Property (Ste...

Graham Stephan

4,980,431 views

38:34

$100M In Real Estate From Scratch

UpFlip

1,241,931 views

24:20

Contractors Hate Me For Showing You This!

HAXMAN

1,573,263 views

46:19

Robert Kiyosaki’s Proven Strategies for Cr...

The Rich Dad Channel

2,129,441 views

57:03

Dr. Hiranandani - The KING Of Real Estate ...

Raj Shamani

1,987,283 views

![How I Turned $10,500 into $210,000 at 19 (in 90 days) [Beginner Real Estate]](https://img.youtube.com/vi/fnFWKmDGGUU/mqdefault.jpg)

20:42

How I Turned $10,500 into $210,000 at 19 (...

Meet Kevin

1,740,868 views

8:14

"I Got Rich When I Understood This" | Jeff...

Business Motiversity

11,560,400 views

22:15

Top 5 Rules for Real Estate Investing

Kris Krohn

86,268 views

12:21

Garage Flooring Is Expensive. Do This Inst...

HAXMAN

673,998 views