The Secret To Telling Where a TRADE Will Go Next | Step by Step

327.06k views2742 WordsCopy TextShare

Umar Ashraf

#technicalanalysis #tradingadvice #stockmarket

I use TradeZella to track and journal my trades.

ht...

Video Transcript:

the magic question every Trader has is how do you tell if a trade is going to go higher or lower before you would essentially get in now obviously there's no crystal ball in the market to tell you when a trade will go higher or lower however there are certain tools and things in the market that we as Traders can use to our advantage to give us a higher probability of exposing where the weakness in the market is and where the strength in the market is and by doing so we will have a higher chance of

being profitable in this video we are going to talk about what causes the market to go higher or lower how the market facilitates trades and how we can take advantage of this to identify opportunities so now let's break down the first thing how does the market move or what causes the market to move now the market moves under the one fundamental truth which is supply and demand our job as Traders is to understand how supplying demand works and how we can correlate it to trading now just like anything else supply and demand fundamental truth is

that whenever Supply is more than demand prices will go down whenever demand is higher and Supply prices will go up very simple truth our job is to take that and incorporate it within our trading now to understand it is one thing to apply it is another now the way we apply it to our trading is our job as Traders is to identify areas that are of supply and areas that are of demand once we identify these areas our job is then to identify if and when we get into these zones do buyers get more aggressive

or do sellers become more aggressive now I know this might be new to a lot of you guys but I'm gonna break it down and simplify that in a bit now with most things with supply and demand we actually have a set quantity right right so you might have 10 iPhones and if there's 10 iPhones available at a given time and there's so many people that want the iPhones that will cause the price to go higher now in the world of trading for every buyer there is a seller so if there are 10 people looking

to buy 10 shares or 10 contracts right for those 10 contracts to be traded they have to buy them from someone else they have to buy 10 other contracts which leads me to my next Point how does the market facilitate trades the market operates off an auction house now the idea of an auction house is you have buyers and sellers and the market essentially is the middleman that facilitates the trades it takes the buyers and it takes the sellers and it comes into an equilibrium of price that's where the auction house does its job and

that is exactly how the market facilitates its trades now in the market or in the auction house we have two types of orders we have an aggressive order also known as a market order and we have a passive order also known as a limit order so keep these two terminologies in mind whenever I talk about aggressive buyers or you know aggressive sellers it comes into how these orders are placed so this is where we go into the order book so in order for the market to facilitate trades the market has something called an order book

our job as Traders is to understand how an order book works and understand how we can use it to our advantage there are different types of order books we might have the depth of the market we might have level two and so on but our ultimate idea right now is to understand how an order book operates and how we can use it to our advantage so here is an example of an order book so when we look at this order book we can see on the left side we have buyers on the right side we

have sellers this is the price So currently this stock or this trade is trading around a hundred and one dollars this is the fair market Price this is what the market thinks this stock is worth at this particular moment now the orders that we see as I mentioned before we have passive orders and we have aggressive orders these are all passive orders also known as limit orders right so the way limit orders operate is whenever a Trader places an order so for example let's say I come in here and I say I want to buy

a hundred shares of this stock at whatever price I pick let's say I pick ninety eight dollars if I want to buy a hundred shares of this stock at 98 what will happen is this number will go from 400 to now 500 because now I have a limit order play to buy at 98 right so this number will increase now if I place a limit order or a passive order right to sell a hundred shares at let's say 104 what will happen is this number at 104 will go from 500 to 600. so once again

these are all limit orders these are all passive orders now Market orders are essentially orders that are hitting the bid or hitting the ask immediately A lot of times we'll see aggressive orders come in and aggressively hit the bid hit the ask now every order that we see come in to the market guys every single order will pop up in something called time and sales and time and sales we can see every single trade executed at time with the price and volume so if I come in right now and I say well I want to

buy a hundred shares of this stock let's just call this stock a or let's call it Bitcoin or whatever we want to call it right let's say it's called stock a if I want to buy a hundred shares of stock a at Market order what I'm essentially telling the market is I'm telling the market that I want to buy a hundred shares at whatever the market price is now in order for the market to sell me a hundred shares it will have to go to a bot it will have to go to someone that is

selling right so the first seller is at 101 uh dollar price and the second seller is at 102. so if I place an order for a hundred shares I want to buy a hundred shares what will ultimately happen is I will get filled 72 shares at 101 and the remaining 28 shares right the remaining 28 shares to fill in my order of 100 will get filled at 102 because this will get blocked out right the moment I hit a market order but as I mentioned before think about it as an auction house we have buyers

on one side we have sellers on one side now the buyers May sometimes Place passive orders or limit orders on where they want to buy and sellers may also Place orders where they potentially want to sell now the difference is when aggressive Traders step into the market they will pay whatever price so I'll give you an example so let's imagine an iPhone an iPhone currently is going for 1 000 US dollars so if it's going for 1 000 US Dollars that's the market price now imagine someone comes in and they say I want to sell

my iPhone for eleven hundred dollars if they want to sell their iPhone for eleven hundred dollars and it goes into the market one of two things are gonna happen number one buyers are going to immediately buy the iPhone because the demand is so much that they are willing to pay whatever it is to purchase that iPhone at that given time meaning they are aggressive buyers or or no one is interested in paying the high premium which is eleven hundred dollars and no one is interested in spending or being as aggressive on the buying side to

be the buyer at that price point and if that doesn't happen that means there's no activity at those levels there's no interest at those levels and buyers will not drive the price higher now I know it sounds a lot it sounds very confusing and it sounds all over the place I'll show you guys some examples in a bit but the main concept that we want to understand here is we want to try to understand how do we read an aggressive buyer and how do we read an aggressive seller once we are able to identify that

that will give us the ultimate advantage on reading price action and reading what the market is doing at critical levels such as our supply and demand levels now the question is how do we put this together right so just to really recap and just kind of breaks things down number one how's the market move through supply and demand we have to take supply and demand understand that incorporate that into our trading once we understand supply and demand and we understand how to apply these levels and zones our next step is to understand the order book

we understand the depth of Market we understand level two we understand time and sales we basically understand how to read it the idea of reading it is to be able to identify the strength of buyers and the strength of sellers we want to be able to identify who's more aggressive and who's able to actually identify you know what the fair value price is at that given time if we as Traders can identify that and we can replicate that that will give us a huge Advantage now there are a lot of tools to kind of look

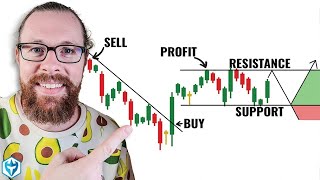

at order flow there's a lot of tools to look at the Dom level two and so on but right now I just want to focus on how to put it together so here's a chart as you guys can see I have a chart of a stock and just looking at the stock we have a few levels going on we have uh right here you guys can see we have Supply zones massive Supply zones and every time we're coming into these Supply zones you can see we're fading the next day we open we see a rejection

at those Supply zones again we also have a nice nice demand Zone we bounced off that on day one the second day that's exactly where we bounced off again and when we weren't able to hold this demand Zone we started selling off now the job of doing all of this and understanding is how do we understand when this trade gets to this Zone it will have a high probability of going higher or will it have a high probability of going lower this is where reading order flow comes in this is where putting the pieces together

comes in this is where looking at the depth of market and understanding who's more aggressive and who's more passive and so on kicks in and I'll share some things with you guys right so what I look for during these times two things that I use is one thing is I look at footprint charts footprint charts allows me to understand the strength of the given star candle whatever the case is at that given time right I will make a separate video on footprint charts and how I use them and another thing I use is I really

focus on the depth of Market to understand how orders are being executed and how orders are going through the market are they aggressive are they passive are the aggressive orders able to drive this higher or are the aggressive orders not able to drive the tire right so imagine there's a huge aggressive orders on the buy side here buyers are very aggressive extremely aggressive but they're not able to drive this price higher that means that there's a lot of passive orders sitting that keep hitting the bid that keep coming in and the buyers keep buying it

up right that the buyers do not have effort to drive this price higher so when I see buyers are unable to drive a price higher regardless of how aggressive they are the that sometimes shows me that there's a big seller sitting on the sidelines that has passive orders and they keep selling and they keep selling and they keep selling and they're able to be more aggressive even though it's not showing on the tape and even though it's not showing on the tape I'm looking at it through the orders being filled and the action that is

happening on the chart so that is what I start looking for at these Key Supply zones these demand zones and if I'm able to read that there is strength here if I'm able to read that there is an identification of this possibly being aggressive or passive depending on the side it's at I will go ahead and take this trade and execute based on that understanding so just to recap everything once again my whole way of looking at trading as mentioned before I look at price I look at volume right when I look at price and

volume I like to see who's more aggressive is the buyers is this the sellers if the buyers are more aggressive are they able to drive the price higher are they able to get to higher price point or are they just more aggressive but they're not able to drive the price higher right I'm also looking at areas that show me Supply areas that show me the band areas that show me Interest where is the most traded volume where is the most interest within the intraday session I look for these zones once I'm able to identify these

zones I look at the depth of market and I break it down to identify once again who is more stronger buyers or Sellers and from there I facilitate my trades now I want to leave you guys with a few things some of this seems very complicated some of this seems very easy there is a mixture of both right reading order flow there's it's kind of like a art right it's there there's a lot of different elements that we as Traders need to put together to be able to recognize Market opportunities and recognize the real Market

strength it's not just something as simple as looking at your screen looking at the chart and saying well this is telling me to buy or this is telling me to sell it takes very long for you to gain the intuitive side of reading order flow intuitive side of reading the tape intuitive side of just reading the action happening within the market to basically identify what the next thing will happen is the best way to learn in my opinion is to put in screen time you have to know a what you're looking for you have to

be intentful and you have to add it with Market structure now in the upcoming weeks I plan to make more videos covering these topics I plan to give you guys trade breakdowns of how what trades I've taken with the same context breaking the context down and just going deeper into this whole new world of trading and with that being said if you guys have any questions anything that seems a little bit confusing comment down below and let me know and like I said in the upcoming weeks I want to go more and more deeper I

want to show you guys real live examples and show you how I utilize order flow how I utilize footprint charts and how I utilize looking at the market from a different angle to give myself an edge in the overall markets

Related Videos

19:47

The Game-Changing TRADING Tool of 2024

Umar Ashraf

614,242 views

12:07

8 Trading Rules To Become Profitable in 20...

Umar Ashraf

327,888 views

19:09

How I Made $27K Day Trading with My Favori...

Umar Ashraf

313,332 views

23:50

10 Reasons Why You're NOT Making Money Day...

Umar Ashraf

351,861 views

9:14

I ONLY Focus on These 2 Things In Trading ...

Umar Ashraf

735,321 views

19:55

How I Made $93,800 Day Trading with This O...

Umar Ashraf

291,430 views

9:26

6 Things I Stopped Doing To Become A Profi...

Umar Ashraf

490,176 views

14:15

How I Day Trade Like a Business

Umar Ashraf

384,904 views

19:00

Psychological Mistakes Traders Make AND Ho...

Umar Ashraf

399,044 views

13:47

9 Things I Learned From Making $878,000 Tr...

Umar Ashraf

147,331 views

20:39

I risk $107 to make $7,500 in Trading… Thi...

Umar Ashraf

886,625 views

42:25

How to Build a Profitable Trading Strategy...

Umar Ashraf

310,333 views

21:57

Stop trading Candlestick charts... Do this...

Umar Ashraf

733,933 views

9:24

Trading Psychology is Bullsh*t... here's why.

Umar Ashraf

293,073 views

54:42

Umar Ashraf revealed MILLIONAIRE'S TRADING...

Humbled Trader

212,958 views

51:01

Master ORDER FLOW TRADING in Less than ONE...

Fractal Flow - Pro Trading Strategies

123,849 views

17:23

Master Institutional Supply and Demand Tra...

Photon Trading

929,174 views

31:05

I made $21K in 32 minutes DAY TRADING my b...

Umar Ashraf

331,307 views

10:35

How I Recover From Trading Losses | Step b...

Umar Ashraf

191,604 views

55:18

How to Read Candlestick Charts (with ZERO ...

Ross Cameron - Warrior Trading

2,423,686 views