🔴 Your Moving Average Strategies DO NOT WORK... Unless You Use These 3 Secrets

14.95k views2191 WordsCopy TextShare

Trader DNA

🔴 FREE DOWNLOAD TRADING SYSTEMS:

https://forexwot.com/ma-cross-system-for-forex-and-stock-market.ht...

Video Transcript:

I've set up a trading system that automatically displays My Chosen moving averages on any chart I open this makes it really easy and quick for me to analyze the market you can set this up yourself on any trading platform since moving averages are a standard indicator available on all platforms so you'll need to adjust your moving average settings to fit the current market conditions there's no one size fits all moving average crossover that works in every Market you'll need to regularly backst and tweak your settings to find what works best for you with my trading

setup the moving averages automatically adjust based on the charts time frame allowing me to scan the entire stock market for stocks that behave similarly you might agree with this here's what most Market experts and new Traders say about moving averages you use short-term and long-term moving averages to decide when to buy or sell based on when they cross each other so you buy when the averages cross upwards the price Rises and you make a profit then you sell and profit again it seems like making money is simple but here's the catch this kind of success

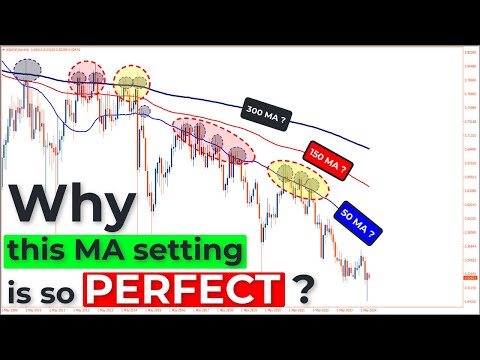

only happens about 20% of the time check out this chart it shows what a typical trading day looks like it's pretty confusing right there's no clear pattern and it's hard to make a profit with all the ups and downs and false signals if you're trying to trade based on moving average crossovers in a market like this you could quickly lose your money from my 15E years of trading experience I can tell you that moving average crossovers don't always work as well as many courses claim so in the next few minutes I'll reveal the key secrets

about moving averages show you how to use them correctly and explain how I incorporate crossovers into my trading strategy so if you're new to the channel make sure to subscribe hit the notification Bell and give us a like to show your support so why are moving average crossovers so popular the reason is that moving averages are Trend indicators and since the start of trading you've been told that the trend is your friend so trading gurus and indicator developers want to make everything easy with clever ideas that is starting with the magic question why don't you

use two or three moving averages to increase your chances but here's the hard truth every new Trader needs to understand after 15 years of trading I found that moving average crossovers don't work well on shorter time frames in fact they often cause more harm than good I have created and tested hundreds if not thousands of moving averages combinations some worked okay but others could wreck your account from my experience trading crossovers on 1 minute 5 minute or 15minute charts is usually a tough game if you discover a magical moving average crossover strategy that consistently works

well on shorter time frames please share it with me or alternatively if you have developed a highly successful moving average crossover strategy that consistently works well on shorter time frames like on 1 minute 5 minute or 15minute charts you could consider selling it online to new Traders around the world on the other hand the situation is different with higher time frames on higher time frames we have a different story and you may be able to make significant profits from your moving averages crossover trading strategy however it's important to understand why trading crossovers on Lower time

frames can be risky this approach often results in frustration and poor performance let me explain the potential dangers and why this strategy might not work well in the short term the biggest and unavoidable limitation of the moving average indicator is that it always lags behind the actual price the price moves first and only after that does the moving average respond this means that if you use a moving average crossover strategy your trading signals will always be delayed compared to the current market price essentially the moving average is a trend following tool which means it can

only show you when a trend is already underway this illustrates how the moving average reflects past price movements rather than providing real-time predictions when using moving averages for trading it's important to understand the issue of noise moving averages are great tools because they help smooth out the erratic fluctuations in price data making it easier to see and follow the overall market trends however moving averages are not perfect and still have to deal with Market noise noise refers to the random and unpredictable price movements that can make it hard to interpret market trends accurately the more

intense the noise the less reliable the moving average indicator becomes for instance on shorter time frames like 1 minute 5 minute or 15minute charts you may encounter many false signals especially when the market is consolidating or experiencing High volatility this happens because the price is fluctuating rapidly which can lead to misleading signals from the moving average another problem with using the moving average crossover system is when the market is moving sideways trading with a crossover strategy in a sideways Market can be really frustrating sideways markets where prices move in a narrow range without clear direction

are challenging no matter if you're trading on short time frames like 1 minute 5 minute or 15 minute charts or on longer ones like daily weekly or monthly charts your stoploss might not work effectively and no matter which moving average you use the crossover strategy just doesn't perform well in these conditions so if you're a day trader it's best to avoid using crossover strategies on shorter time frames they can quickly drain your account but don't worry there's a better way to use moving averages I'll show you how moving averages are great tools for figuring out

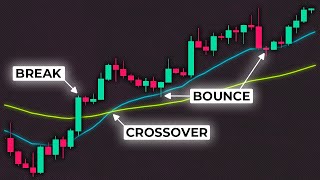

the trend direction of your trading instrument while understanding price action and Market structure should be your main focus you can quickly get a sense of the market Trend just by checking the slope of the moving moving average line here's how to use moving averages effectively first use them to identify and confirm the market Trend since moving averages are lagging indicators you can look at the slope to see the trend if the line is sloping upward it's an uptrend if it's sloping downward it's a downtrend you can also use the position of the price relative to

the moving average line to guide your trades if the price is above the moving average you should focus on looking for bu trades on the other hand if the price is below the moving average you should look for sell opportunities a stock or currency pair is in an uptrend when the price is above the moving average and the moving average line is sloping upward conversely it's in a downtrend when the price is below the moving average and the line is sloping downward another way to use moving averages is a support and resistance levels this method

is commonly used by Price action Traders for these Traders moving averages can act as Dynamic support and resistance areas because they just based on recent price movements since many Traders follow moving averages you'll often see them working well as support and resistance levels on charts the simple moving average can serve as a dynamic support or resistance level Additionally the space between two moving averages can also act as a dynamic support or resistance Zone long-term moving averages like the 200 period moving average are considered more significant for Price levels and tend to give fewer false signals

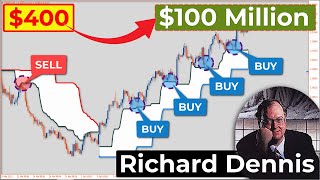

compared to Shorter term moving averages let's talk again about moving average crossovers this system works well and can accurately catch trends when the market is moving strongly in One Direction however in a sideways Market where prices are stuck in a Range this system can lead to many losing trades which can be risky for your account on shorter time frames like one minute or 5 minute charts the odds are even less favorable so are moving average crossovers worthless not really for Traders and investors who use longer time frames like daily weekly or even monthly charts moving

averages are much more effective and can provide more reliable signals but there's another issue to consider the moving average crossover system often works on a stop and reverse basis this means you're always in the market with the strategy when a new signal comes up you exit your current position and enter a new one in the opposite direction at first this strategy might seem straightforward and easy to use whether you're trading manually or with a robot but in reality even on longer time frames it can be quite risky in this scenario Trends often move in a

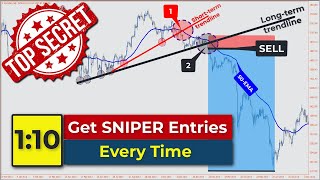

smooth manner which makes them easy to analyze using the moving average indicator however such smooth Trends are rare So relying solely on moving average crossovers may not always be effective a more reliable approach is to open a trading position only after the trend is clearly established for instance you should consider buying only when there is a clear bullish Trend indicated by Rising prices and the price being above the long-term moving average line which should also be trending upwards additionally it's wise to wait for a price correction where the market temporarily moves down before resuming its

upward Trend and only then look for a bullish signal to enter a buy position to minimize losses remember to wait for the complete formation of a Candlestick before entering a trade based on a Buy Signal many Traders have made made the mistake of trading on a crossover signal before the Candlestick closed which often leads to poor trades by waiting for the Candlestick to close and confirm the signal you can avoid many problematic entries and improve your trading outcomes once you enter a trade there are several ways to manage it to boost your profits and reduce

risk if the market moves against you with the moving average crossover strategy you typically stay in the trade until you get an opposite signal this means you're always in the market waiting for the signal to exit many new Traders follow this method because it seems like the standard approach but from my experience this method can be inconsistent because it's success depends a lot on Market Behavior often it's white Traders end up exiting the market too late which can hurt your profits Instead try using other strategies like setting a fixed profit Target using Fibonacci extensions to

set targets or looking at visual support and resistance levels these methods might help you manage your trades better personally I find that using a fixed profit Target with a risk to reward ratio of 1 to three works really well next I'll show you the best settings for combining moving average indicators based on different time frames this will be a valuable tool if you're using the moving average crossover strategy I personally use different moving averages depending on the chart and time frame for H4 charts and shorter I use EMA 34 and EMA 14 on daily charts

I use EMA 200 and EMA 50 for weekly and monthly charts I go with EMA 100 and EMA 20 these settings help me find good buy entries on stocks and currency pairs with strong fundamentals but they aren't set in stone it really depends on the specific stocks and currencies you're trading I've set up a trading system that automatically displays My Chosen moving averages on any chart I open this makes it really easy and quick for me to analyze the market you can set this up your yourself on any trading platform since moving averages are a

standard indicator available on all platforms or in this video I've included a template with the system that you can simply upload to your chart and it will automatically plot all these indicators perfectly on your charts so there's nothing for you to worry about get the download link on the description however you can use other moving average settings for your own crossover signals the market changes over time sometimes it Trends smoothly and other times it's erratic and directionless so you'll need to adjust your moving average settings to fit the current market conditions there's no one size

fits all moving average crossover that works in every Market you'll need to regularly backst and tweak your settings to find what works best for you with my trading setup the moving averages automatically adjust based on the charts time frame allowing me to scan the entire stock market for stocks that behave similarly as always if you learn something new or if you want more videos more often make sure you subscribe click the notification Bell and leave us a like to show your support see you next time [Music]

Related Videos

22:12

WRC 2024 – Крупнейшая выставка роботов в К...

PRO РОБОТОВ

224,248 views

![🔴 [1:10] Risk Reward Ratio RSI-CCI Trading (You'll Never Lose Again)](https://img.youtube.com/vi/Myf4u_rEBO0/mqdefault.jpg)

10:17

🔴 [1:10] Risk Reward Ratio RSI-CCI Tradin...

Trader DNA

50,330 views

20:01

20 САМЫХ МАЛЕНЬКИХ ЛЕТАТЕЛЬНЫХ АППАРАТОВ В...

TechZone

361,841 views

1:49:48

Rusija Lietuvoje? Šarūnas Jasiukevičius

NeRedaguota

36,542 views

![🔴 [1000 Pips/Day Trading] Best MACD & STOCHASTIC Strategy (With 1:5 Risk Reward Ratio)](https://img.youtube.com/vi/bLyw_DG9zAo/mqdefault.jpg)

14:30

🔴 [1000 Pips/Day Trading] Best MACD & STO...

Trader DNA

42,920 views

16:24

🔴 The Flipper SCALPING Strategy: Top 5 Be...

Trader DNA

35,872 views

11:40

🔴 (1 Minute SCALPING) Best CCI-MACD Strat...

Trader DNA

32,490 views

11:31

Use Moving Averages Like A Pro ( 7 HACKS )

Trade Prime

456,225 views

13:07

🔴 EMA-SUPERTREND : These 3 SECRET STEPS W...

Trader DNA

62,230 views

11:30

🔴 (100% SNIPER Entries) - This "MACD-STOC...

Trader DNA

44,954 views

20:20

40 фраз из повседневного английского (медл...

LinguaTrip TV

349,327 views

12:23

🔴 EMA-STOCHASTIC OSCILLATOR Hidden Diverg...

Trader DNA

35,714 views

30:11

Вечности быть не должно. Тогда почему она ...

SciOne

564,052 views

58:19

Ultimate Step-by-Step Guide to Technical A...

Ross Cameron - Warrior Trading

384,290 views

11:15

🔴 $10K Profit/Day With "MACD - Trend RSI ...

Trader DNA

32,941 views

15:38

5 & 20 EMA INTRADAY TRADING STRATEGY | MOS...

Trader Chitra

478,442 views

13:19

🔴 Simple Trading System That Made Million...

Trader DNA

71,681 views

13:53

I Found The Hidden Trading Pattern That Co...

TRADE ATS

162,080 views

9:47

🔴 3X Better Than MACD & RSI - EMA Trendli...

Trader DNA

41,911 views

13:55

🔴 MA-RSI MARUBOZU - The ONLY Price Action...

Trader DNA

19,922 views